Think about that, as soon as each few months, you could launch data detailing your present monetary standing. The general public can see the place you’ve spent cash, made cash, and even how a lot you’ve saved.

Sounds intimidating, proper?

That’s only a totally different means of describing what earnings season is.

The interval is undoubtedly hectic for market contributors, with firms lastly revealing what’s transpired behind closed doorways.

And on prime of being hectic, it’s unattainable to understate the significance of the interval. For these questioning why it’s so essential, let’s have a look at three causes that assist clarify its significance.

Vital Enterprise Updates

Earnings stories present market contributors with a plethora of data, together with revenues, bills, and income, simply to supply a couple of easy examples. It’s essential for traders to obtain this data, because it provides a deeper view into the enterprise and permits them to see any potential pink flags.

Meta Platforms META posted adjusted EPS of $8.02 and report gross sales of $48.4 billion in its newest quarterly print, reflecting development charges of fifty% and 21%, respectively. Internet revenue of $20.9 billion was the corporate’s highest learn ever.

Beneath is a chart illustrating the corporate’s gross sales on a quarterly foundation.

Picture Supply: Zacks Funding Analysis

Share Worth Affect

An organization’s quarterly earnings report generally impacts its inventory worth, a theme market contributors have undoubtedly observed. Sometimes, we’ll see bullish share motion post-earnings from firms that shock positively or increase their steering, reflecting wholesome enterprise.

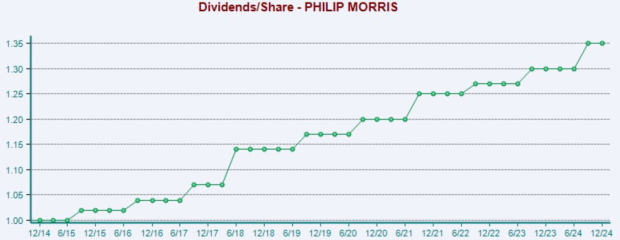

Philip Morris PM shares benefited properly from its newest set of better-than-expected outcomes, with EPS rising 14% alongside a robust 7% transfer greater in gross sales. Demand has remained robust for the tobacco titan, with product improvements remaining key for its future.

The corporate has lengthy been a favourite amongst income-focused traders due to years of persistently greater payouts.

Picture Supply: Zacks Funding Analysis

It’s price noting that implementing a stop-loss at a snug threshold will assist restrict spooky post-earnings worth swings, preserving valuable capital.

Earnings Season Highlights Present Traits

Earnings season may also present a big-picture view of general tendencies inside the financial system or industries.

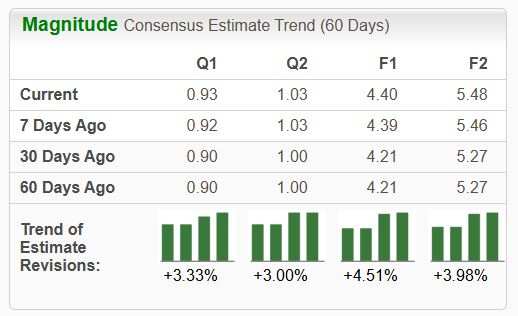

It additionally supplies perception into present enterprise tendencies inside industries, permitting traders to place themselves appropriately. For instance, NVIDIA NVDA has posted strong Knowledge Heart outcomes as of late due to the AI growth.

NVIDIA’s outlook continues to stay bullish, sporting a good Zacks Rank #2 (Purchase).

Picture Supply: Zacks Funding Analysis

Backside Line

Whereas earnings season is undeniably hectic for everybody concerned, that’s simply the character of the interval.

It’s necessary for traders to know why it issues for a lot of causes, together with offering traders with an up to date monetary standing, the unstable worth swings generally seen post-earnings, and the general image it supplies on market and business tendencies.

7 Greatest Shares for the Subsequent 30 Days

Simply launched: Consultants distill 7 elite shares from the present record of 220 Zacks Rank #1 Sturdy Buys. They deem these tickers “Most Possible for Early Worth Pops.”

Since 1988, the total record has overwhelmed the market greater than 2X over with a median achieve of +24.3% per 12 months. So make sure you give these hand picked 7 your fast consideration.

Philip Morris International Inc. (PM) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.