On Oct. 22, Starbucks (NASDAQ: SBUX) introduced its 14th consecutive annual dividend improve, boosting the quarterly payout by 7% to $0.61 per share or $2.44 per share per 12 months. Starbucks began as a development inventory however has since reworked right into a extremely dependable dividend inventory with a ahead yield of two.6%. The dividend has develop into a core a part of Starbucks’ funding thesis. Like clockwork, traders have been in a position to rely on annual raises each September or October.

This is why Starbucks shares had been really down the morning of Oct. 23, and whether or not the dividend stock is price shopping for now.

Picture supply: Getty Photos.

Starbucks within the highlight

Starbucks traders have been on a curler coaster in 2024. The inventory plummeted in Could after reporting disappointing second-quarter outcomes. The third-quarter outcomes weren’t significantly better, however no less than they indicated Starbucks could have begun to appropriate course.

On Aug. 9, stories surfaced that activist investor Starboard Worth had taken a stake within the firm, an indication {that a} shake-up might be so as. Then, the massive information got here on Aug. 13 when Starbucks introduced it had poached the extremely esteemed Chipotle Mexican Grill CEO, Brian Niccol, to develop into the brand new chairman and CEO of Starbucks. The inventory climbed a staggering 25% on Aug. 13, its finest single-session efficiency in historical past.

On Sept. 10, Niccol wrote a letter titled Again to Starbucks, which mentioned the power of the brand, a return to the coffeehouse type that made it beloved within the first place, and a renewed emphasis on high quality elements and passionate baristas.

The inventory value had principally retained its Aug. 13 beneficial properties, an indication of optimism that traders had been wanting ahead to the fourth-quarter and full fiscal 2024 report on Oct. 30, reasonably than dreading it. That’s, till Starbucks pre-announced its quarterly outcomes on Oct. 22.

A painful reminder

Corporations will typically select to announce preliminary outcomes after they need to cushion the blow from a nasty earnings report or to easily draw attention to the future rather than the past. That definitely appears to be what Starbucks is doing, given its horrible outcomes.

The preliminary outcomes confirmed a 7% international comparable-store gross sales (comps) decline; a 3% decline in consolidated internet income; and a drop of $0.80 in earnings per share (EPS), representing a decline of 25% beneath typically accepted accounting rules (GAAP) and 24% on an adjusted, or non-GAAP, foundation.

For the total fiscal 12 months, comps had been down 2%; consolidated internet income was up 1%; and each GAAP and adjusted EPS had been $3.31, down 8% on a GAAP foundation.

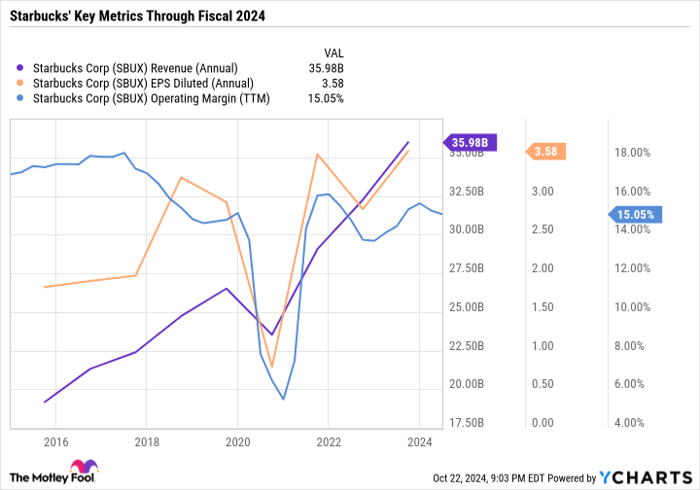

Starbucks was coming off a file 12 months with $36 billion in gross sales and $3.58 in EPS. However regardless of that banner 12 months, the inventory value had languished as a result of the outcomes weren’t all that spectacular in comparison with pre-pandemic figures, and development prospects (particularly in China) gave the impression to be weakening.

As you may see within the chart, outcomes rebounded properly from a brutal 2020, however fiscal 2024 earnings weren’t that spectacular in comparison with pre-pandemic years as a consequence of decrease margins.

SBUX revenue (annual); information by YCharts. TTM = trailing 12 months.

Along with the preliminary outcomes and the dividend elevate, Starbucks launched a video of Niccol titled The Path Ahead. He did not shrink back from the unhealthy outcomes, probably in an try to make it clear these outcomes solely partly got here beneath his tenure as CEO and that the long run could be totally different. He mentioned the next within the video:

Folks love Starbucks, however I’ve heard from some clients that we have drifted from our core, that we have made it tougher to be a buyer than it must be, and that we have stopped speaking with them. Consequently, some are visiting much less typically, and I believe as we speak’s outcomes inform that very same story. To welcome all our clients again and return to development, we have to basically change our latest technique.

The upcomingearnings callwill be an opportunity for Niccol and the remainder of the administration group to show to analysts why the trail ahead shall be one price taking for traders. Particularly, they need to watch to see how the CEO touches on enhancements to the client and worker expertise, the price of these enhancements, and in the event that they coincide with transforming shops or constructing new ones to resemble the traditional cafe type. Possibly we’ll get new foods and drinks choices to complement that type.

The corporate’s second greatest market, China, had been its biggest development catalyst however has since became its greatest ache level. Within the video, Niccol mentioned that the U.S. could be the precedence within the close to time period and Starbucks would give attention to returning China and the remainder of the worldwide enterprise to development.

All advised, the message requires Starbucks to return to its roots and restore its model.

The turnaround is way from full

Starbucks is at a crossroads. The inventory is roughly the identical value as we speak because it was 5 years in the past, and traders are rising impatient with the corporate’s overpromising and underdelivering. It desperately wanted new management, and Niccol might be the individual to steer the ship in the fitting path. However till there are significant indicators of enchancment, the corporate will probably stay in wait-and-see mode.

The excellent news is that the outcomes aren’t horrible. The corporate remains to be extremely worthwhile and might greater than afford its dividend with earnings. The yield is strong, particularly in comparison with what traders can get from a consumer discretionary exchange-traded fund or an S&P 500 index fund.

Traders who consider within the model and agree with Niccol that its issues are solvable could do properly to purchase shares of the espresso chain. However Starbucks may stay a risky inventory till it lays its new basis and Wall Avenue digests administration’s plans for the corporate’s future.

Do you have to make investments $1,000 in Starbucks proper now?

Before you purchase inventory in Starbucks, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 best stocks for traders to purchase now… and Starbucks wasn’t one among them. The ten shares that made the minimize may produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… when you invested $1,000 on the time of our advice, you’d have $860,447!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of October 21, 2024

Daniel Foelber has positions in Starbucks. The Motley Idiot has positions in and recommends Chipotle Mexican Grill and Starbucks. The Motley Idiot recommends the next choices: quick December 2024 $54 places on Chipotle Mexican Grill. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.