Over the previous few weeks, the inventory market had seen the biggest month-to-month decline for the reason that COVID-19 pandemic. In fact, the post-pandemic restoration would find yourself making the COVID-19 plunge a kind of once-in-a-lifetime alternatives to reap large returns when the market rebounded.

The present financial situation could also be completely different however one factor that continues to be the identical is that the development of earnings estimate revisions will assist buyers navigate which shares to spend money on, which is what the Zacks Rank is based on.

To that time, following the Zacks Rank will permit buyers to see which firms are navigating a tariff-induced financial slowdown successfully. Whereas it is by no means sensible to guess towards the inventory market’s long-term prospects, the jitters are comprehensible because the Trump administration has applied the very best tariffs on imports in over a century. It will actually have international financial ramifications, particularly with some nations prone to counter with reciprocal tariffs of their very own.

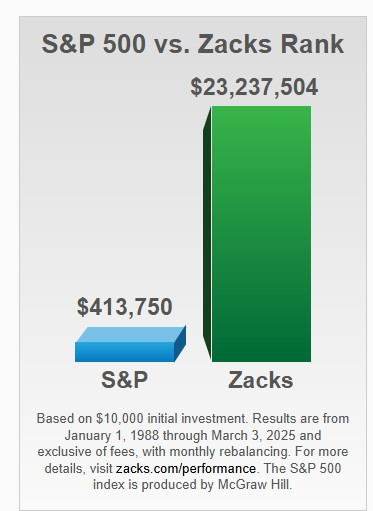

Nonetheless, the Zacks Rank may also help, with it noteworthy that the Zacks Rank #1 (Robust Purchase) shares have greater than doubled the S&P 500 with a mean achieve of +23.9% per 12 months since 1998.

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

Market Recalibration & Cape Ratio Considerations

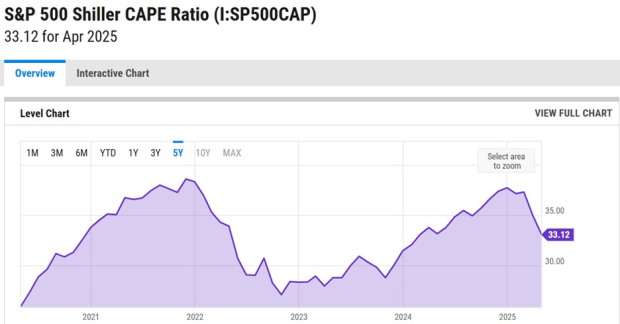

With many analysts calling for a recalibration out there, famed investor and billionaire Jeffrey Gundlach has identified that the Cape ratio on the S&P 500 had been close to its second-highest stage ever at 38X, suggesting shares are nonetheless overvalued.

Also referred to as the Shiller P/E ratio, the Cape ratio is used to calculate the worth of the inventory market or particular person shares relative to their common inflation-adjusted earnings over the past 10 years, smoothing out fluctuations attributable to financial cycles. Though the ahead earnings a number of on the S&P 500 is at an inexpensive 20.1X, the Cape ratio nonetheless stands at 33.1X in comparison with its historic common of 16.9X.

Notably, Gundlach has known as for a 60% likelihood of a recession, stating that leverage buyers could also be liable to chapter amid massive market swings whereas firms take care of tariff ramifications versus provide chain points in the course of the pandemic.

Picture Supply: YCHARTS

Utilizing The Magazine 7 as an Instance

There is no such thing as a doubt that intriguing long-term shopping for alternatives are being offered, and lots of buyers could also be scoping out the Magazine-7 shares resembling EV chief Tesla TSLA, AI chip chief Nvidia NVDA, and electronics big Apple AAPL.

Apple for example could also be positioned in a tough spot for buyers to contemplate whether or not it is time to purchase on the dip with AAPL just lately buying and selling close to its 52-week low of $164 a share earlier than rebounding to only below $200. Whereas Apple’s inventory remains to be buying and selling 23% from its 52-week excessive, the corporate shall be considerably affected by tariffs because it depends closely on worldwide manufacturing in China, India, and Vietnam.

The Zacks Rank suggests it could be time to fade the current rally in AAPL off its lows, as earnings estimate revisions have continued to say no over the past quarter and are down within the final week for fiscal 2025 and FY26. This has led to Apple’s inventory touchdown a Zack Rank #4 (Promote).

Picture Supply: Zacks Funding Analysis

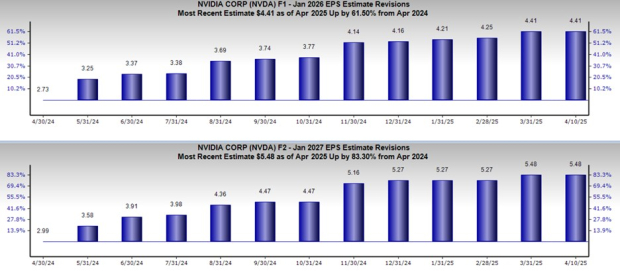

It is noteworthy that Nvidia is the one Magazine 7 inventory that has a purchase score (Zacks Rank #2) for the time being because the chipmaker has seen a pleasing development of optimistic earnings estimate revisions, suggesting NVDA needs to be in retailer for a sharper rebound than its massive tech friends. The development of rising EPS estimates has continued over the past 12 months with NVDA nonetheless up +25% throughout this era regardless of an 18% dip in 2025.

Picture Supply: Zacks Funding Analysis

ASLE is an Intriguing Addition to the Zacks Rank #1 Checklist

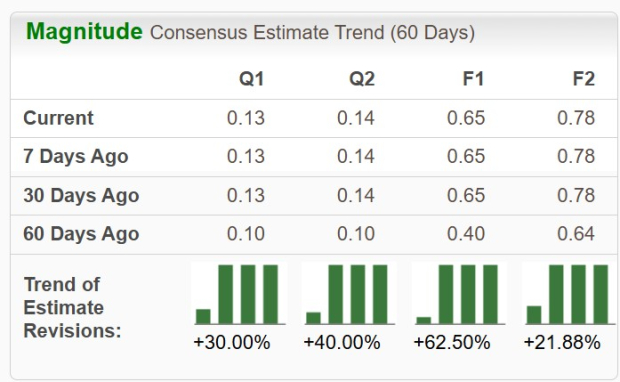

Buying and selling below $10 a share, AerSale’s ASLE inventory is an intriguing addition to the Zacks Rank #1 (Robust Purchase) record. AerSale offers built-in, diversified aviation aftermarket services for plane homeowners and operators to understand financial savings within the operation, upkeep, and monetization of their plane, engines, and parts. Notably, AerSale’s Zacks Aerospace-Protection Gear Trade is at the moment within the high 9% of over 240 Zacks industries.

Benefiting from its sturdy enterprise surroundings, EPS estimates have soared for AerSale over the past 60 days, with annual earnings now anticipated to skyrocket 261% this 12 months to $0.65 per share in comparison with $0.18 in 2024. Plus, FY26 EPS is projected to extend one other 20% to $0.78.

Picture Supply: Zacks Funding Analysis

Backside Line

With earnings estimate revisions seen as essentially the most highly effective pressure impacting inventory costs, following the Zacks Rank will certainly be helpful amid heightened market volatility, as a historic commerce conflict performs out.

Zacks Names #1 Semiconductor Inventory

It is just one/9,000th the scale of NVIDIA which skyrocketed greater than +800% since we really useful it. NVIDIA remains to be sturdy, however our new high chip inventory has way more room to growth.

With sturdy earnings development and an increasing buyer base, it is positioned to feed the rampant demand for Synthetic Intelligence, Machine Studying, and Web of Issues. World semiconductor manufacturing is projected to blow up from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Apple Inc. (AAPL) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

AerSale Corporation (ASLE) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.