Arcosa, Inc. ( ACA) is not a solar name or a real pure-play renewable resource supply. Rather, the framework items as well as services company is gaining from several megatrends consisting of renewable resource, electrification, telecommunications growth, across the country framework investing, as well as much more.

ACA supplied amazing support in late April that’s aided send out the supply to fresh highs. Despite the fact that Arcosa supply has actually climbed up by 55% in the in 2015 as well as squashed the marketplace considering that ACA’s launching in late 2018, its evaluation is much from overheated as well as Arcosa still rests well listed below its existing ordinary Zacks cost target.

United State Framework Investing Boom

Arcosa supplies infrastructure-related items as well as services throughout building, crafted frameworks, as well as transport markets. Arcosa is gaining from megatrends such as maturing framework, along with the “ongoing change to eco-friendly power generation, as well as the growth of brand-new transmission, circulation, as well as telecoms framework.”

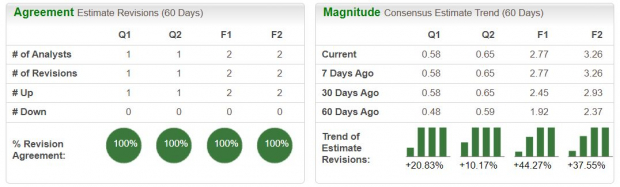

Arcosa’s development has actually been strong considering that it dilated from Trinity Industries in late 2018. ACA smashed Zacks Q1 revenues quote in late April as well as given widely positive support. ACA’s monetary 2023 agreement quote has actually risen by 44% considering that its record, with FY24’s number 38% greater. ACA’s fundamental positivity assists it get a Zacks Ranking # 1 (Solid Buy) today.

Picture Resource: Zacks Financial Investment Study

Arcosa’s crafted frameworks department consists of energy frameworks, telecommunications frameworks, wind towers, as well as past. ACA’s wind tower company is flourishing, having actually landed wind tower orders worth over $1.1 billion that expand right into 2028 considering that the flow of the Rising cost of living Decrease Act (August 2022).

ACA is profiting straight from the $1 trillion united state Framework Expense as well as the $370 billion Rising cost of living Decrease Act, which Arcosa execs anticipate will certainly produce multi-year tailwinds for a number of its organizations.

The gusts at Arcosa’s back consist of grid-hardening, electrification of automobiles, linking renewable resource to the grid, the cordless 5G telecommunications buildout, as well as much more. Arcosa is developing out a brand-new production center in New Mexico to sustain its wind market development, especially in the Southwest.

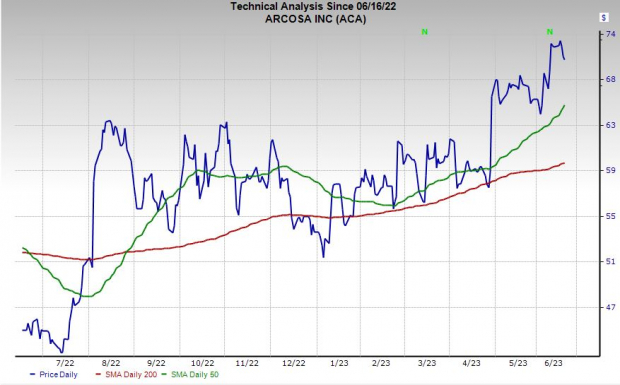

Picture Resource: Zacks Financial Investment Study

Various Other Principles

Zacks approximates require Arcosa’s modified 2023 revenues to rise by 27% and afterwards leap an additional 18% greater in 2024 to get to $3.26 per share. ACA has actually covered our EPS quotes by approximately 60% in the tracking 4 quarters, consisting of a 112% beat in Q1.

The firm’s profits is forecasted ahead in about level YoY in 2023. ACA unloaded its tank company in October 2022. As soon as the contrasts are smoothed out, Zacks requires Arcosa to publish 10% profits development in 2024 to get to $2.46 billion.

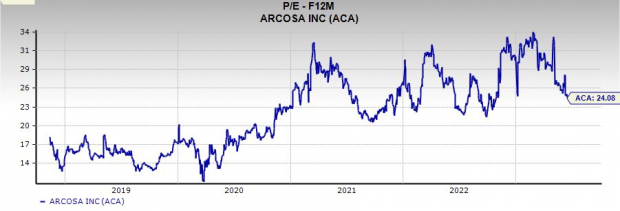

Picture Resource: Zacks Financial Investment Study

Arcosa shares rose following its late-April launch as well as it has actually struck several brand-new highs over the last month-plus. ACA is up 32% YTD as well as 55% in the in 2015 to squash the S&P 500’s 21% run as well as its highly-ranked Zacks market’s 38%. ACA supply has actually climbed up 160% considering that it started selling late 2018 to surprise the S&P 500’s 64% as well as its market’s 82%.

ACA is cooling down a little bit lately, having lately unclothed overbought RSI region to closer to neutral. Arcosa still trades much over its 50-day relocating standard, as well as ACA rests 13% listed below its ordinary Zacks cost target.

Regardless of Arcosa’s market as well as industry-topping efficiency over the last year as well as 5 years, ACA is trading at a 30% price cut to its very own highs at 24.1 X ahead 12-month revenues.

Picture Resource: Zacks Financial Investment Study

Profits

The $3.5 billion market cap company with a typical trading quantity of around 215K is getting much more favorable interest from Wall surface Road, according to Zacks broker agent suggestions. Arcosa pays a really little returns presently, however it has lots of space to gradually increase the payment moving forward.

Generally, Arcosa seems a rather under-the-radar as well as solid method to acquire direct exposure to several lasting patterns in the united state as well as international economic situation. And also its current slip establishes a much better entrance factor.

( Disclosure: Ben Rains possesses ACA in the Zacks Choice Power Innovators solution)

Free Record Exposes Exactly How You Can Benefit from the Expanding Electric Lorry Market

Internationally, electrical auto sales proceed their amazing development also after exceeding in 2021. High gas costs have actually sustained his need, however so has progressing EV convenience, functions as well as modern technology. So, the eagerness for EVs will certainly be about long after gas costs stabilize. Not just are makers seeing record-high revenues, however manufacturers of EV-related modern technology are bring in the dough also. Do you recognize just how to money in? Otherwise, we have the best record for you– as well as it’s FREE! Today, do not miss your opportunity to download and install Zacks’ leading 5 supplies for the electrical lorry change at no charge as well as without any responsibility.

>>Send me my free report on the top 5 EV stocks

Arcosa, Inc. (ACA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as point of views shared here are the sights as well as point of views of the writer as well as do not always show those of Nasdaq, Inc.