Vertiv VRT is a picks-and-shovels AI inventory that’s companions with the present king of AI, Nvidia, and can develop regardless of who ultimately dominates synthetic intelligence.

Vertiv inventory has soared 700% prior to now two years and 90% YTD, but it trades 15% under its highs.

Vertiv’s AI and Large Knowledge Bull Case

Vertiv’s energy, cooling, and IT infrastructure options and companies function throughout knowledge facilities, communication networks, and past. Vertiv helps the computing energy wanted to drive the fashionable financial system run as easily as doable across the clock.

Vertiv’s product classes embrace vital energy, thermal administration, racks & enclosures, and monitoring & administration. On the identical time, its companies vary from DC energy and electrical reliability to security and compliance and far more.

Vertiv works with small and medium-sized companies and enterprises throughout healthcare, retail, telecom, training, and different vital elements of the financial system.

Picture Supply: Zacks Funding Analysis

Vertiv is working with the present champion of AI, Nvidia NVDA, to assist remedy future knowledge heart effectivity and cooling challenges.

Vertiv grew its natural orders by 57% within the second quarter. “We proceed to see elevated scaling of AI deployment and Vertiv has the capability in place to grab this pivotal second whereas persevering with to put money into capability for the longer term,” Vertiv chief govt Giordano Albertazzi stated in ready Q2 remarks.

Vertiv’s earnings estimates have jumped since its second quarter launch, extending its spectacular stretch of upward EPS revisions over the past yr and a half. VRT’s enhancing bottom-line outlook helps it earn a Zacks Rank #1 (Robust Purchase), and it has topped our EPS estimates by a mean of 13% within the trailing 4 quarters.

Picture Supply: Zacks Funding Analysis

Vertiv is projected to develop its adjusted EPS by 46% in FY24 and 28% in FY25 to achieve $3.31 a share subsequent yr. This earnings growth would come after VRT grew its backside line by 230% in 2023.

Vertiv is projected to extend its income by 13% in 2024 and 2025 to drag in almost $9 billion subsequent yr.

Vertiv Inventory’s Efficiency, Technical Ranges, and Valuation

Vertiv inventory has soared over 800% within the final 5 years, roughly 700% prior to now two, and 90% YTD. These runs put Vertiv up there with the likes of Nvidia, whereas blowing away Meta and different tech giants.

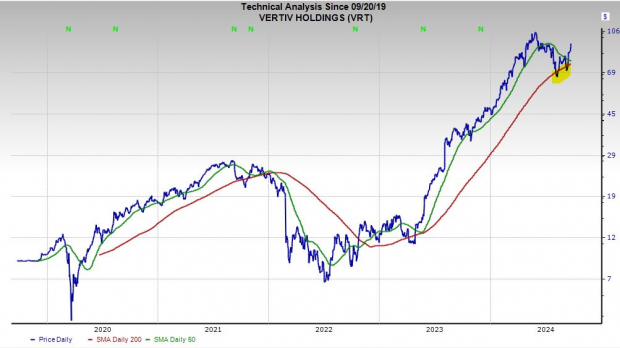

Picture Supply: Zacks Funding Analysis

Vertiv lately rebounded above its 21-week shifting common. Vertiv additionally discovered assist at its 200-day shifting common earlier this month for the second time since early August.

VRT inventory is again above its 50-day and 21-day shifting averages. On high of that, Vertiv trades roughly 15% under its Could peaks.

On the valuation entrance, VRT trades at a 24% low cost to its highs at 29.7X ahead 12-month earnings. Vertiv inventory gives 22% worth in comparison with its highly-ranked Computer systems – IT Companies business.

VRT’s spectacular relative worth is in place though Vertiv has climbed 300% prior to now three years to blow away its business’s 4% decline.

Backside Line on Vertiv Inventory

The fixed growth of knowledge facilities and the rise of AI methods, cryptocurrencies, and different new applied sciences present Vertiv with an enormous development runway for many years. This is the reason Wall Avenue loves Vertiv inventory, with all 11 brokerage suggestions Zacks has for Vertiv sitting at “Robust Buys.”

5 Shares Set to Double

Every was handpicked by a Zacks knowledgeable because the #1 favourite inventory to realize +100% or extra in 2024. Whereas not all picks will be winners, earlier suggestions have soared +143.0%, +175.9%, +498.3% and +673.0%.

Many of the shares on this report are flying underneath Wall Avenue radar, which supplies an excellent alternative to get in on the bottom flooring.

Today, See These 5 Potential Home Runs >>

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Vertiv Holdings Co. (VRT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.