The renowned claiming that financiers ought to never ever place their eggs in one basket stems from the basic concept that diversity reinforces a profile.

United Wellness Team ( UNH) and also United Rentals ( URI) are 2 titans in their corresponding sectors that can provide variety and also maybe unify financiers’ profiles with solid efficiencies.

Allow’s see if currently is a great time to purchase United Health and wellness and also United Rentals supply.

Diverse Direct Exposure

Sharing an usual recommendation in their names, United Health and wellness supplies varied direct exposure to the health care market while United Rentals does the exact same to the building and construction and also structure products room.

United Health and wellness supplies a large range of health care services and products, such as health care companies (HMOs), factor of solution strategies (POS), chosen supplier companies (PPOs), and also handled fee-for-service programs. United Health and wellness has the biggest and also most varied subscription base in the managed-care company market.

Picture Resource: Zacks Financial Investment Study

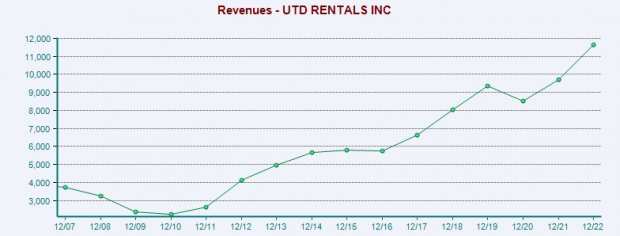

When It Comes To United Rentals, URI is the biggest devices rental firm worldwide. United Rentals’ client base consists of building and construction and also commercial firms, energies, communities, federal government companies, independent professionals, house owners, and also various other people that make use of devices for tasks that vary from straightforward repair work to significant remodellings.

Picture Resource: Zacks Financial Investment Study

Efficiency & & Assessment

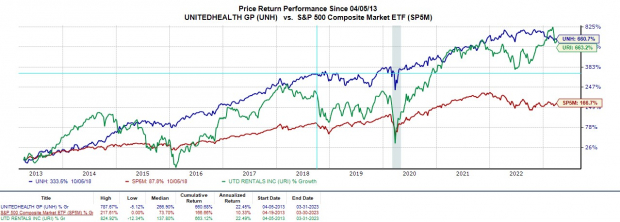

Year to day, United Rentals supply is up +10% to leading United Health and wellness’s -10% and also the S&P 500’s +6%. Also much better, United Rentals supply has actually skyrocketed +312% over the last 3 years with United Health and wellness up +99% to both leading the criteria’s +64%.

Additionally, over the last years, United Health and wellness and also United Rentals supplies have actually climbed up over 600% to greatly outshine the wider market.

Picture Resource: Zacks Financial Investment Study

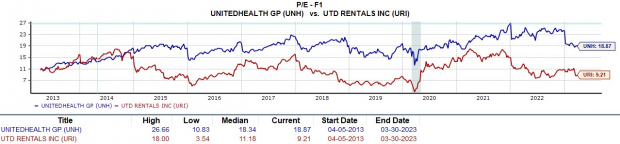

United Health and wellness supply professions at $472 per share and also 18.8 X onward revenues which is over the market standard of 13.4 X however on the same level with the S&P 500’s 18.6 X. And also, United Health and wellness is a market leader and also professions 30% listed below its years high of 26.6 X and also near to the mean of 18.3 X.

In contrast, United Rentals shares profession at $395 and also simply 9.2 X onward revenues. This is well below the criteria and also its very own market standard of 13.4 X. Also much better, United Rentals supply professions 49% listed below its decade-long high of 18X and also at a 17% price cut to the mean of 11.1 X.

Picture Resource: Zacks Financial Investment Study

Development & & Expectation

In addition to its really appealing assessment, United Rentals’ revenues are anticipated to jump 29% this year to $41.92 per share contrasted to EPS of $32.50 in 2022. Monetary 2024 revenues are anticipated to increase an additional 9%.

Revenues approximates alterations have actually trended greater throughout the quarter. On the leading line, sales are anticipated to climb up 20% in FY23 and also side up an additional 4% in FY24 to $14.52 billion.

Picture Resource: Zacks Financial Investment Study

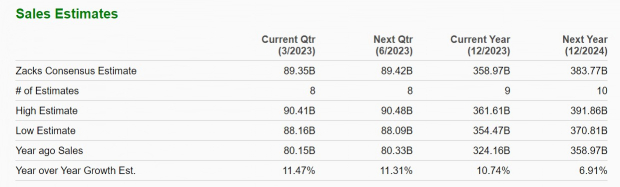

Rotating to United Health and wellness, revenues are forecasted to increase 12% in FY23 and also dive an additional 13% in FY24 at $28.22 per share. Revenues price quotes are somewhat up over the last 90 days. Sales are anticipated to be up 10% this year and also increase an additional 7% in FY24 to $383.77 billion.

Picture Resource: Zacks Financial Investment Study

Takeaway

Right now United Health and wellness and also Untied Rentals supply both sporting activity a Zacks Ranking # 2 (Buy). The leading and also profits development of both firms is still outstanding and also suggests there can be a lot more upside in their supplies.

This can most definitely hold true when taking into consideration the historic efficiencies of United Health and wellness and also Untied Rentals supply. To that factor, financiers might intend to think about getting both supplies as they provide variety and also supremacy in their corresponding sectors.

Free Record Exposes Exactly How You Might Benefit from the Expanding Electric Lorry Sector

Worldwide, electrical automobile sales proceed their impressive development also after exceeding in 2021. High gas costs have actually sustained his need, however so has progressing EV convenience, attributes and also innovation. So, the eagerness for EVs will certainly be about long after gas costs stabilize. Not just are producers seeing record-high earnings, however manufacturers of EV-related innovation are generating the dough too. Do you understand exactly how to money in? Otherwise, we have the ideal record for you– and also it’s FREE! Today, do not miss your opportunity to download and install Zacks’ leading 5 supplies for the electrical lorry transformation at no charge and also without commitment.

>>Send me my free report on the top 5 EV stocks

UnitedHealth Group Incorporated (UNH) : Free Stock Analysis Report

United Rentals, Inc. (URI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also viewpoints revealed here are the sights and also viewpoints of the writer and also do not always mirror those of Nasdaq, Inc.