Capable of exceed its Q1 expectations on Wednesday, Delta Air Strains DAL inventory bought an additional increase as President Trump’s determination to briefly rescind reciprocal tariffs on most international locations (Outdoors of China), despatched markets hovering.

With the 90-day tariff recension serving as an additional catalyst following Delta’s favorable Q1 report, DAL shares skyrocketed +23% in in the present day’s buying and selling session. That mentioned, Delta’s inventory remains to be down 26% yr thus far and buyers are certainly questioning if the sharp rebound can proceed.

Picture Supply: Zacks Funding Analysis

Delta’s Q1 Outcomes

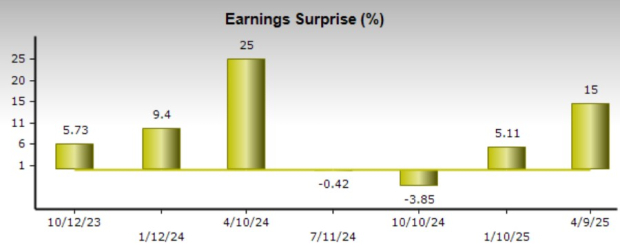

Offering one of many first glimpses of the Q1 earnings season, Delta reported first-quarter gross sales of $14.04 billion, topping estimates of $13.8 billion and rising from $13.74 billion a yr in the past. On the underside line, Q1 internet revenue got here in at $240 million, or adjusted earnings of $0.46 per share which topped estimates of $0.40 by 15% and was barely up from EPS of $0.45 within the comparative quarter.

Notably, Q1 working money circulate was at $2.4 billion with Delta’s working revenue at $569 million, on an working margin of 4%.

Picture Supply: Zacks Funding Analysis

Delta’s Cautious Steering

As a result of broader financial uncertainty round world commerce, Delta CEO Ed Bastian said the corporate plans to guard margins and money circulate by lowering deliberate capability progress within the second half of the yr whereas actively managing prices and capital expenditures.

Given the dearth of financial readability, Delta didn’t present a full-year outlook however expects Q2 likelihood between $1.5 billion-$2 billion and EPS within the vary of $1.70-$2.30 which got here in under the present Zacks Consensus of $2.62 per share or 11% progress. Delta expects Q2 gross sales at $16.3 billion-$17 billion, and in vary of the Zacks Consensus of $16.71 billion or 0.3% progress.

Delta’s Low cost Valuation

Following the YTD drop in DAL shares, what definitely attracts long-term buyers to Delta’s inventory is the corporate’s low cost valuation. Buying and selling at $44, Delta’s inventory is at a 5.2X ahead earnings a number of which is under its Zacks Transportation-Airline Business common of seven.5X and is roughly on par with American Airways AAL and United Airways UAL.

Moreover, DAL trades at simply 0.3X gross sales and effectively under the optimum stage of lower than 2X with the business common at 0.5X.

Picture Supply: Zacks Funding Analysis

Backside Line

For now, Delta’s inventory lands a Zacks Rank #3 (Maintain). Whereas it wouldn’t be stunning if the rally in DAL had been to proceed, extra upside could largely depend upon the pattern of earnings estimate revisions within the coming weeks as analysts digest the corporate’s cautious steerage and the non permanent rescission of Trump’s reciprocal tariffs.

5 Shares Set to Double

Every was handpicked by a Zacks professional because the #1 favourite inventory to achieve +100% or extra in 2024. Whereas not all picks will be winners, earlier suggestions have soared +143.0%, +175.9%, +498.3% and +673.0%.

A lot of the shares on this report are flying beneath Wall Road radar, which gives a terrific alternative to get in on the bottom flooring.

Today, See These 5 Potential Home Runs >>

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

American Airlines Group Inc. (AAL) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.