AGNC Funding (NASDAQ: AGNC) seems to be like an earnings inventory, but it surely does not really behave like one. Or no less than not one that almost all dividend-focused traders will wish to personal.

And whereas falling rates of interest will probably be a web profit to the enterprise, the enhancing surroundings will not be sufficient to show this roughly 14% ultra-high-yield inventory into one {that a} dividend investor will wish to purchase. This is what it’s essential to know earlier than you let a giant yield suck you into an funding mistake.

What does AGNC Funding do?

AGNC Funding is a mortgage real estate investment trust (REIT). Its construction was designed to offer small traders entry to institutional-level actual property investments, with the concept they might be capable of profit from the money flows such belongings can produce.

The truth is, one of many keys to being labeled as a REIT is that an organization should pay out no less than 90% of taxable earnings as dividends. That enables REITs to keep away from corporate-level taxation, although it is vital to notice that their dividends are taxed at an investor’s regular earnings tax fee. (Uncle Sam nonetheless desires his lower.)

Picture supply: Getty Photographs.

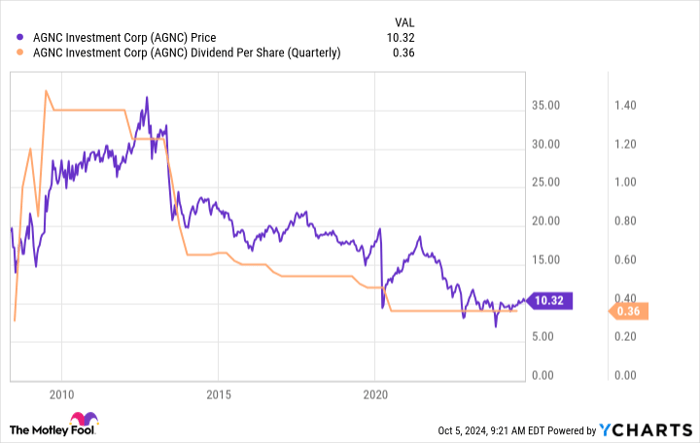

From this big-picture perspective, AGNC appears like an earnings inventory, significantly if you add within the enormous dividend yield. However there’s an issue right here if you have a look at the inventory graph and overlay the dividend historical past on that graph. Discover how the purple line, the inventory value, spiked larger initially after which headed steadily decrease. That is the identical pattern that the orange line, the quarterly dividend fee, follows.

Take into consideration that for a second. Should you had been a dividend investor making an attempt to dwell off the earnings your portfolio generates, would you wish to personal a inventory that has a excessive yield however a value that retains falling and a dividend fee that does the identical? On the finish of the day, you’d have much less earnings and fewer capital, which is simply concerning the worst attainable consequence based mostly in your funding objectives.

Decrease charges will probably be good for AGNC Funding

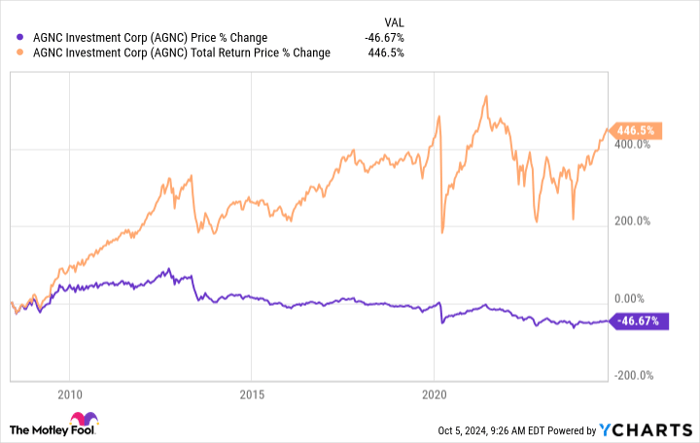

This is the place the vital wrinkle is available in. AGNC is a total-return funding, which assumes the reinvestment of dividends. If you do this, the efficiency story adjustments dramatically.

On this graph under, the orange line is the overall return, and it’s strongly optimistic in comparison with the steadily declining purple line, which continues to be the inventory value. The dividend the REIT pays is so massive that in case you purchase extra shares of AGNC, the fee greater than makes up for the value declines within the inventory.

This is not how income-focused traders do issues. It’s how institutional traders, like pension funds, do it, usually utilizing an asset allocation model. If that is what you’re doing, go forward and purchase AGNC Funding and reinvest the dividends.

In case you are a dividend investor, AGNC simply is not made for you. And now’s the time if you would possibly must metal your resolve on this level.

As a mortgage REIT, AGNC Funding buys mortgages which have been pooled collectively into bond-like securities. These belongings commerce all day lengthy and are affected by quite a lot of distinctive elements.

However probably the most vital is rates of interest. Rising charges are likely to depress bond costs, and falling charges are likely to assist bond costs. As charges fall, AGNC Funding’s enterprise is more likely to perk up and so, too, might its inventory value.

If competitors within the mortgage house heats up, maybe as a result of extra banks get into the enterprise once more (after avoiding it following the Great Recession), there could possibly be much more profit to AGNC Funding’s portfolio of mortgage bonds if the costs of those securities get bid up.

The outlook for mortgage REITs like AGNC Funding is improving considerably. However the enchancment is not everlasting: it is topic to the whims of the Federal Reserve and the broader mortgage market.

From a total-return perspective, AGNC is likely to be readying for a interval of robust efficiency. Who is aware of, it would even hike its dividend. However none of that may change the essential nature of the REIT, which is able to nonetheless be targeted on whole return.

Watch out what you purchase if you’re trying to dwell off your dividends

Simply having a giant dividend yield is not sufficient to make a inventory a compelling addition to a dividend-focused portfolio. Should you want the dividends to pay on your dwelling bills, maybe as a complement to your Social Security check, it’s essential to personal corporations which can be dependable payers.

Historical past may be very clear: Mortgage REITs like AGNC Funding will not be dependable dividend payers. An enormous yield and an enhancing enterprise outlook, because of rates of interest, will not change that truth.

Must you make investments $1,000 in AGNC Funding Corp. proper now?

Before you purchase inventory in AGNC Funding Corp., take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 best stocks for traders to purchase now… and AGNC Funding Corp. wasn’t certainly one of them. The ten shares that made the lower might produce monster returns within the coming years.

Think about when Nvidia made this record on April 15, 2005… in case you invested $1,000 on the time of our advice, you’d have $826,069!*

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of October 7, 2024

Reuben Gregg Brewer has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.