Palantir Applied sciences (NASDAQ: PLTR) was one of many hottest synthetic intelligence (AI) shares of 2024. Its inventory jumped 340% in 2024, which means it greater than quadrupled in worth in only one yr. That extraordinary efficiency is not frequent, however with the entire tailwinds within the AI area, some traders are questioning if Palantir’s inventory worth may double in worth in 2025.

An examination of 1 metric concerning Palantir straight addresses this stage of efficiency, and shareholders ought to take discover of it to find out what to do with their holdings. Potential traders contemplating the inventory may also have an interest.

Begin Your Mornings Smarter! Get up with Breakfast information in your inbox each market day. Sign Up For Free »

Palantir’s software program has discovered a use case in a number of fields

Palantir is an AI firm that gives purpose-built options for its shoppers. Initially, its target market was authorities entities, however that finally expanded to incorporate industrial clients. The first use of its software program is to run giant quantities of information via pre-built AI fashions, after which current its findings to these with decision-making authority. This provides these individuals the most effective data potential on the time with which to decide.

One of many newest additions to Palantir’s product line is its Synthetic Intelligence Platform (AIP). AIP is Palantir’s reply to the generative AI development. AIP permits its customers to combine AI fashions right into a enterprise’s internal workings and automate many processes. It additionally features a function for AI brokers to carry out duties that had been as soon as performed by individuals, additional solidifying its use case.

AIP has pushed an enormous spike in demand for Palantir’s software program, particularly on the U.S. industrial facet of its enterprise. In Q3, Palantir’s whole income elevated at a 30% clip to $726 million, whereas U.S. industrial income rocketed 54% larger to $179 million. Clearly, the U.S. industrial enterprise is not Palantir’s largest section, however it’s the firm’s fastest-growing one.

Alongside its sturdy development, Palantir is worthwhile, persistently producing around 20% profit margins.

PLTR Profit Margin (Quarterly) knowledge by YCharts.

Whereas another software program firms’ revenue margins can surpass 30%, 20% remains to be a noteworthy determine, because it exhibits that administration values profitability alongside development.

These are some sturdy monetary outcomes, however do they add as much as an organization that may double its market cap in 2025?

Palantir’s valuation may hinder its inventory’s success in 2025

It is arduous to debate that Palantir is not a implausible firm that is succeeding within the AI arms race. Nevertheless, the market has seen this success as outright dominance and bid up the inventory to unreasonable ranges. Palantir’s income elevated 30% yr over yr this final quarter, however the inventory rose 340% for the yr. One thing does not add up there, and the disparity seems in Palantir’s valuation.

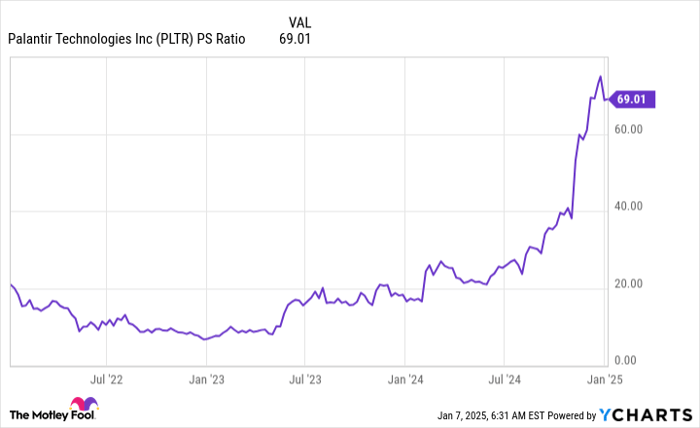

A inventory’s valuation offers traders a relative thought of how a lot the market is prepared to pay for a bit of an organization. Whereas this implies nothing by itself, this can be very helpful when evaluating shares. Most software program shares commerce between 10 and 20 instances gross sales. Palantir trades at 69 instances gross sales.

Knowledge by YCharts.

Traders are paying an enormous premium for Palantir’s inventory over different software program firms which can be rising simply as quick as it’s. Is that this premium value it? I might say no.

AI {hardware} king Nvidia posted a number of quarters in a row the place its income greater than tripled yr over yr. Nevertheless, Nvidia by no means traded for greater than 46 instances gross sales throughout that run. With Palantir’s valuation properly larger than that regardless of far slower development, it is protected to imagine that the inventory could also be in a bubble.

In consequence, I do not suppose the inventory will double in 2025. Actually, I would not be stunned to see it decline all year long. Whereas Palantir, the corporate, is doing implausible and can proceed to supply nice leads to 2025, Palantir, the stock, has already baked in years of growth, and there is not a lot upside left.

Must you make investments $1,000 in Palantir Applied sciences proper now?

Before you purchase inventory in Palantir Applied sciences, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 best stocks for traders to purchase now… and Palantir Applied sciences wasn’t considered one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… in case you invested $1,000 on the time of our advice, you’d have $858,668!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of January 6, 2025

Keithen Drury has positions in Nvidia. The Motley Idiot has positions in and recommends Nvidia and Palantir Applied sciences. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.