We have now Apple and Amazon on deck to report Q1 outcomes this week, and we might want to wait just a few extra weeks earlier than we see Nvidia’s numbers. However we now have already seen Q1 outcomes from the opposite 4 members of the ‘Magnificent 7’ group: Alphabet GOOGL, Microsoft MSFT, Meta META, and Tesla TSLA.

It’s laborious to search out any weak spot within the Microsoft and Alphabet studies, and the market’s response to those two studies exhibits that traders agree with that evaluation. The Alphabet report seems to reassure traders that it has a reputable AI technique in place and is probably not that far behind Microsoft on this crucial race.

The market response to the Tesla and Meta studies must be contextualized.

Meta shares have been very robust performers previous to this report, and any means you take a look at the corporate’s Q1 outcomes, they’re spectacular. Meta’s Q1 earnings have been up +80.5% from the year-earlier interval on +27.3% increased revenues. Buyers’ beef with the Meta report is the corporate’s steerage for capital expenditures, which goes up considerably to strengthen the corporate’s AI capabilities.

I feel the response is overdone, but it surely doubtless reminds traders of the ache created by the corporate’s earlier metaverse plans. Maybe there’s a foundation for these worries, given the metaverse historical past. However as we’re seeing with Microsoft and Alphabet, management in AI requires plenty of spending. If market individuals are okay with Microsoft and Alphabet spending hands-over-fist on AI, then they need to even be okay with Meta.

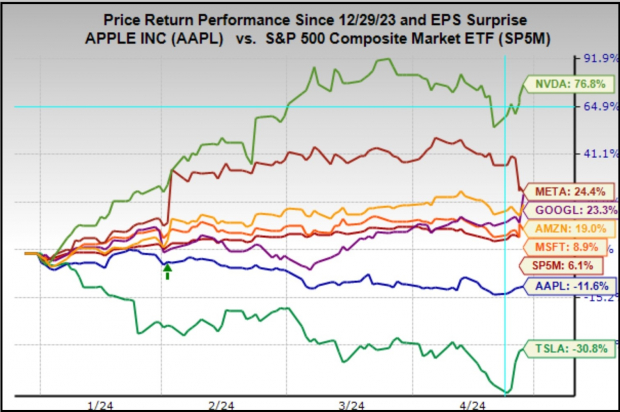

Tesla shares have been the worst performing of the group, with many beginning to converse out that maybe it didn’t should be a part of this group. The inventory worth weak spot displays the steadily deteriorating earnings outlook, with a mix of softening demand and heightened aggressive pressures forcing Elon Musk to chop costs. You may see this within the chart beneath, which plots the inventory worth relative to how EPS estimates for this yr and subsequent have advanced.

Picture Supply: Zacks Funding Analysis

Given this inventory’s worth motion and estimates revision trajectory coming into the quarterly launch, traders have been conditioned to anticipate the worst from Tesla, however the precise outcomes have been merely unhealthy (as an alternative of ‘very unhealthy’). They missed on the top- and backside traces and didn’t present any favorable or reassuring commentary in regards to the outlook. However traders have been relieved that the numbers weren’t as ugly as that they had began fearing.

Tesla shares are nonetheless laggards relative to different Magazine 7 shares, because the year-to-date efficiency chart exhibits.

Picture Supply: Zacks Funding Analysis

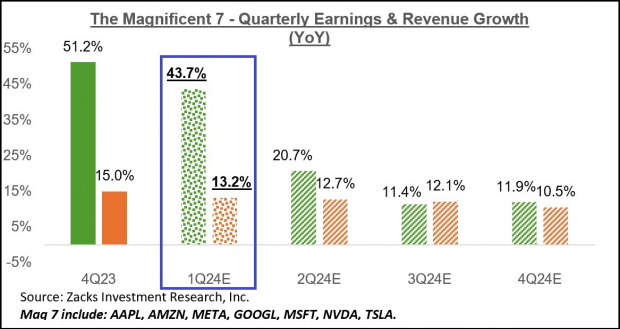

Utilizing estimates for Amazon, Apple, and Nvidia, which can launch their March-quarter outcomes on April thirtieth, Might 2nd, and Might twenty second, respectively, and precise outcomes for the opposite 4 members of the group, whole Q1 earnings for the group are anticipated to be up +43.7% from the identical interval final yr on +13.2% increased revenues.

The chart beneath exhibits the group’s Q1 earnings and income progress efficiency within the context of what we noticed from the group within the previous quarter and what’s at present anticipated for the following three quarters.

Picture Supply: Zacks Funding Analysis

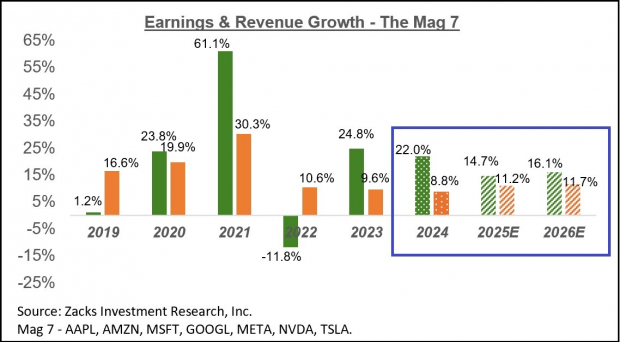

The chart beneath exhibits the group’s earnings and income progress image on an annual foundation.

Picture Supply: Zacks Funding Analysis

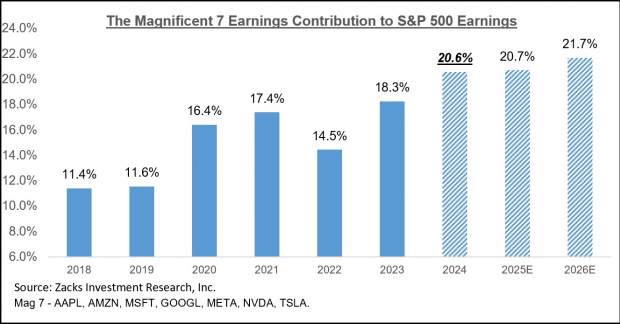

Please be aware that the Magazine 7 corporations at present account for 29.1% of the S&P 500 index’s whole market capitalization and are anticipated to usher in 20.6% of the index’s whole earnings in 2024. For 2023 This autumn, the Magazine 7 group has a much bigger weightage, bringing in 21.6% of all S&P 500 earnings.

The chart beneath exhibits the group’s earnings contribution to the index over time and what’s at present anticipated for the following two years.

Picture Supply: Zacks Funding Analysis

Given the group’s huge earnings energy and progress profile, it’s laborious to argue with its market management.

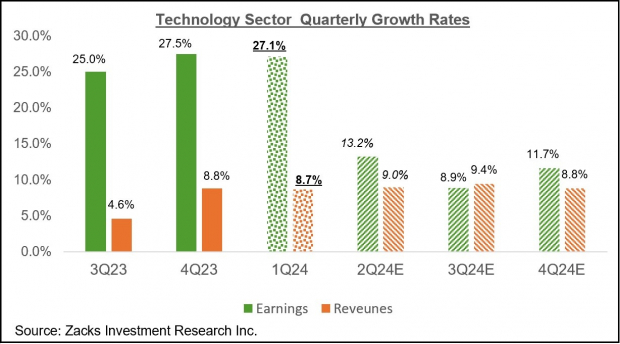

Past these mega-cap gamers, whole Q1 earnings for the Expertise sector as a complete are anticipated to be up +27.1% from the identical interval final yr on +8.7% increased revenues.

The chart beneath exhibits the sector’s This autumn earnings and income progress expectations within the context of the place progress has been in latest quarters and what’s anticipated within the coming 4 durations.

Picture Supply: Zacks Funding Analysis

Earnings Season Scorecard and This Week’s Earnings Reviews

We stay within the coronary heart of the Q1 earnings season this week, with greater than 950 corporations reporting outcomes, together with 177 S&P 500 members. Along with the aforementioned Apple and Amazon studies, we actually have a consultant cross-section of the market on deck to report outcomes this week.

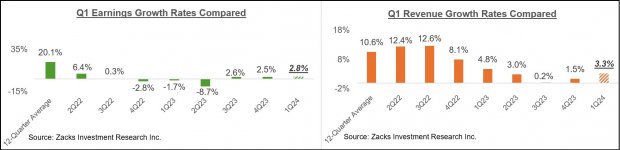

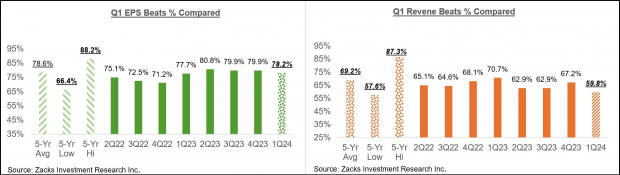

By way of Friday, April 26th, we now have seen Q1 outcomes from 229 S&P 500 index members, or 45.8% of the index’s whole membership. Whole Q1 earnings for these 229 index members are up +2.8% from the identical interval final yr on +3.3% increased revenues, with 78.2% beating EPS estimates and 59.8% beating income estimates.

The comparability charts beneath put the Q1 earnings and income progress charges in a historic context.

Picture Supply: Zacks Funding Analysis

The comparability charts beneath put the Q1 EPS and income beats percentages in a historic context.

Picture Supply: Zacks Funding Analysis

The Earnings Huge Image

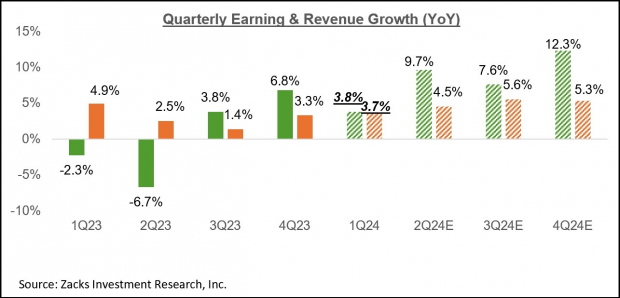

Taking a look at Q1 as a complete, whole S&P 500 earnings are anticipated to be up +3.8% from the identical interval final yr on +3.7% increased revenues, which might comply with the +6.8% earnings progress on +3.3% income positive factors within the previous interval.

The chart beneath exhibits present earnings and income progress expectations for 2024 Q1 within the context of the place progress has been over the previous 4 quarters and what’s at present anticipated for the next three quarters.

Picture Supply: Zacks Funding Analysis

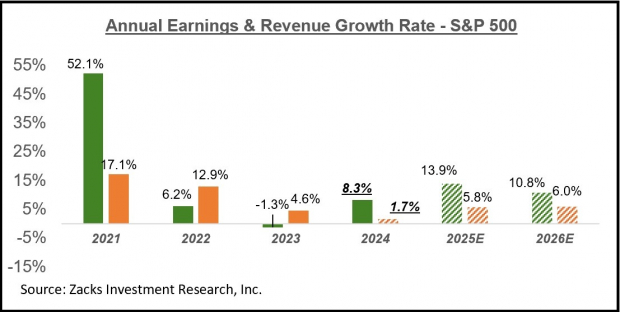

Wanting on the total earnings image on an annual foundation, whole 2024 S&P 500 earnings are anticipated to be up +8.3% on +1.7% income progress.

Picture Supply: Zacks Funding Analysis

For an in depth take a look at the general earnings image, together with expectations for the approaching durations, please take a look at our weekly Earnings Tendencies report >>>> Breaking Down Q1 Earnings Results

Purchase 5 Shares BEFORE Election Day

Biden or Trump? Zacks is releasing a FREE Particular Report, Revenue from the 2024 Presidential Election (regardless of who wins).

Since 1950, presidential election years have been robust for the market. This report names 5 well timed shares to journey the wave of electoral pleasure.

They embody a medical producer that gained +11,000% within the final 15 years… a rental firm completely crushing its sector… an vitality powerhouse planning to develop its already massive dividend by 25%… an aerospace and protection standout that simply landed a probably $80 billion contract… and an enormous chipmaker constructing big vegetation within the U.S.

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.