There are several kinds of spending designs released within the marketplace. Some capitalists favor to target revenue, some favor worth, as well as some favor to target development.

Obviously, those that incline the development spending design frequently target innovation business, as their long-lasting capacity is tough to neglect.

And Also as we have actually seen in 2023, innovation supplies have actually ultimately located purchasers adhering to a ruthless 2022.

3 supplies from the Zacks Computer system as well as Modern technology market– Airbnb ABNB, Arista Networks ANET, as well as MSCI Inc. MSCI– are all anticipated to witness strong top as well as profits development in their corresponding .

Below is a graph showing the year-to-date efficiency of all 3 supplies, with the S&P 500 combined in as a standard.

Photo Resource: Zacks Financial Investment Research Study

Allow’s take a more detailed check out every one.

Airbnb

Airbnb is a leading system for special keeps as well as experiences, offering an industry for linking hosts as well as visitors online or via smart phones. Experts have actually taken a favorable position on the firm’s profits expectation, pressing ABNB right into a Zacks Ranking # 1 (Solid Buy).

Photo Resource: Zacks Financial Investment Research Study

It’s tough to neglect the firm’s development account, with profits anticipated to climb up 21% in its present (FY23) as well as an even more 20% in FY24.

The forecasted profits development begins top of anticipated year-over-year income upticks of 14.9% in FY23 as well as 15.3% in FY24.

Photo Resource: Zacks Financial Investment Research Study

As well as for the cherry on the top, Airbnb published solid quarterly cause its most current launch, going beyond the Zacks Agreement EPS Price quote by almost 80% as well as coverage income 2% in advance of assumptions.

The marketplace suched as the outcomes, with ABNB shares getting greater than 13% in the adhering to trading session.

Photo Resource: Zacks Financial Investment Research Study

Arista Networks

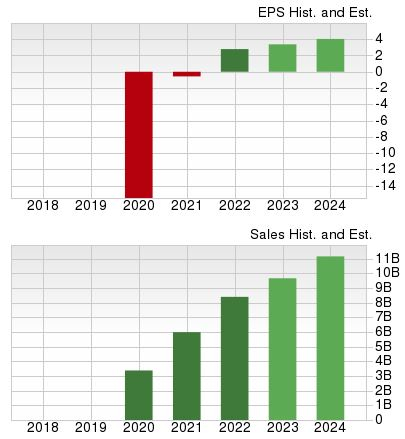

Arista Networks supplies cloud networking remedies for information facilities as well as cloud computer settings. The firm’s profits expectation has actually boosted throughout all durations, touchdown ANET right into a Zacks Ranking # 2 (Buy).

Photo Resource: Zacks Financial Investment Research Study

It’s difficult to neglect the firm’s development trajectory, with the Zacks Agreement EPS Quote of $5.76 for its present (FY23) suggesting a renovation of 26% year-over-year.

As Well As in FY24, the firm’s profits are anticipated to expand a more 12%.

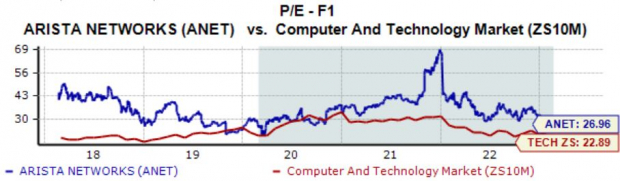

ANET shares profession at a 26.9 X ahead profits several, definitely on the greater end of the range however well listed below the 34.4 X five-year typical.

Technology supplies are normally costly, as that’s the rate capitalists spend for development.

Photo Resource: Zacks Financial Investment Research Study

MSCI Inc.

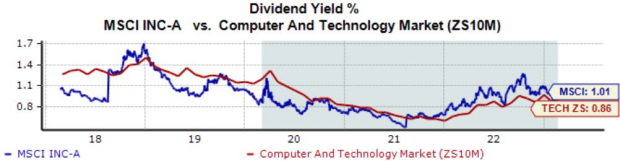

MSCI is a leading supplier of vital choice assistance devices as well as solutions for the worldwide financial investment area, extensively understood for ESG study as well as scores. Presently, the firm sporting activities a Zacks Ranking # 2 (Buy).

Photo Resource: Zacks Financial Investment Research Study

The firm’s development expectation is intense, with quotes anticipating year-over-year profits development of 12% in its present (FY23) as well as 16% in FY24.

Leading line development is likewise obvious, with the firm anticipated to witness 10% year-over-year sales development in FY23 as well as 11.3% in FY24.

Additionally, MSCI shares supply direct exposure to technology combined with an earnings stream; the firm’s yearly reward presently produces 1%, a tick over the Zacks Computer system as well as Modern technology market standard.

Remarkably, the firm’s payment has actually expanded by almost 25% over the last 5 years.

Photo Resource: Zacks Financial Investment Research Study

Profits

Capitalists have their choices within the marketplace as well as for easy to understand factors. While some enjoy a constant revenue stream, others are awarded with eruptive development.

As well as for those curious about business expanding their leading as well as profits at fast rates, all 3 above– Airbnb ABNB, Arista Networks ANET, as well as MSCI Inc. MSCI– are anticipated to do exactly that.

Additionally, all 3 sporting activity a positive Zacks Ranking, suggesting that their near-term company overviews have actually moved favorably.

Simply Launched: Zacks Top 10 Supplies for 2023

Along with the financial investment suggestions talked about over, would certainly you such as to understand about our 10 leading choices for 2023?

From beginning in 2012 via November, the Zacks Top 10 Supplies profile has actually tripled the marketplace, getting an outstanding +884.5% versus the S&P 500’s +287.4%. Our Supervisor of Study has actually currently brushed via 4,000 business covered by the Zacks Ranking as well as handpicked the most effective 10 tickers to purchase as well as keep in 2023. Do not miss your opportunity to still be amongst the very first to participate these just-released supplies.

MSCI Inc (MSCI) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Airbnb, Inc. (ABNB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as viewpoints revealed here are the sights as well as viewpoints of the writer as well as do not always show those of Nasdaq, Inc.