Earnings season has continued to roll alongside at a speedy tempo, with this week’s reporting docket notably stacked. We’ve heard from a number of market heavyweights, together with Meta Platforms META and Netflix NFLX.

Shares of every confronted promoting strain post-earnings, erasing a bit of the year-to-date good points we’ve seen from every inventory. It raises a sound query – is the promoting overdone, or is that this a wealthy alternative for traders? Let’s take a more in-depth have a look at every firm’s quarterly launch.

Netflix

Regarding headline figures, Netflix posted a 17% beat relative to the Zacks Consensus EPS estimate and posted gross sales modestly forward of the consensus, with each gadgets exhibiting appreciable development from the year-ago durations.

Picture Supply: Zacks Funding Analysis

Whole subscribers had been reported at 269.6 million, reflecting a 16% soar year-over-year. Nonetheless, the actual shock within the quarterly launch was that the corporate will not report quarterly membership numbers beginning subsequent yr in 2025 Q1, seemingly explaining the knee-jerk response post-earnings.

Nonetheless, Netflix loved a strong quarter, posting $2.1 billion in free money stream and seeing its year-to-date working margin shifting larger to twenty-eight.1% (20.6% in FY23). The corporate additionally maintained its free money stream outlook of $6 billion for FY24 and repurchased 3.6 million shares all through the interval.

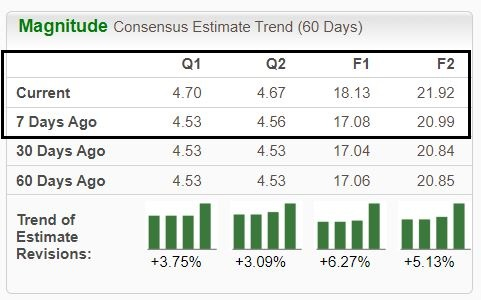

Earnings expectations have moved larger following the discharge, a bullish near-term signal. Netflix is presently a Zacks Rank #2 (Purchase).

Picture Supply: Zacks Funding Analysis

The corporate’s development outlook stays vibrant, with consensus expectations for its present fiscal yr suggesting 50% earnings development on 15% larger gross sales. The inventory sports activities a Model Rating of ‘A’ for Development.

Meta Platforms

Know-how heavyweight Meta Platforms additionally posted a double beat, exceeding the Zacks Consensus EPS estimate by 9% and posting a modest 0.5% gross sales shock. The corporate’s improved operational efficiencies have aided its profitability considerably, with earnings up 80% relative to the year-ago interval.

The sell-off post-earnings will be attributed to Meta’s announcement of upper capital expenditures for the present fiscal yr, which had been raised to a band of $35 – $40 billion (beforehand $30 – $37 billion). Meta raised its CapEx to speed up its infrastructure investments for its synthetic intelligence (AI) roadmap, anticipating larger CapEx for subsequent yr as properly to help its efforts.

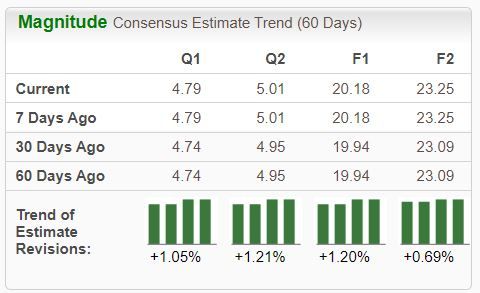

Analysts’ revisions stay constructive, however traders can anticipate changes within the coming days.

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

Nonetheless, the corporate’s promoting enterprise continues to ship, with common value per advert climbing 6% year-over-year alongside a 20% climb in advert impressions throughout its household of apps. And to high it off, the corporate’s working margin moved properly larger to 38% (25% beforehand), reflecting its improved profitability.

Backside Line

Earnings season is all the time thrilling, with firms lastly unveiling what’s transpired behind closed doorways.

To this point, the interval has been primarily constructive, with the massive banks’ outcomes not inflicting any spooks. Netflix NFLX and Meta Platforms META confronted post-earnings promoting strain regardless of each posting strong quarterly outcomes.

Netflix has seen constructive earnings estimate revisions post-earnings, a bullish signal. In the meantime, larger CapEx for Meta scared off some traders, however the inventory stays a chief long-term play for these bullish on synthetic intelligence (AI).

Free – 5 Dividend Shares to Fund Your Retirement

Zacks Funding Analysis has launched a Particular Report that will help you put together for retirement with 5 various shares that pay whopping dividends. They reduce throughout property administration, upscale retailers, monetary establishments, and a few sturdy vitality producers.

5 Dividend Shares to Embody in Your Retirement Technique is filled with unconventional knowledge and insights you gained’t get out of your neighborhood monetary planner.

Download Now – Today It’s FREE >>

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.