Alphabet GOOGL made headlines in Friday’s buying and selling session after crushing its first quarter earnings expectations yesterday night and serving to the broader indexes cap off a powerful rebound.

Surging greater than +10% as we speak, Alphabet shares have been boosted by information that the tech large might be paying its first-ever dividend together with its board of administrators approving $70 billion in inventory buybacks.

Let’s evaluation Alphabet’s charming Q1 report and see if now is an effective time to purchase into the sturdy post-earnings rally with GOOGL up greater than +20% 12 months to this point.

Picture Supply: Zacks Funding Analysis

Q1 Assessment

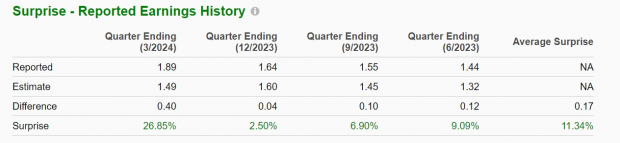

Alphabet’s Q1 earnings elevated 61% to $1.89 per share in comparison with EPS of $1.17 within the comparative quarter. This topped the Zacks Consensus of $1.49 a share by 27%. On the highest line, Q1 gross sales of $67.59 billion expanded 16% from $58.06 billion a 12 months in the past and got here in 2% above estimates.

Picture Supply: Zacks Funding Analysis

The sturdy outcomes have been attributed to Google Search, Cloud, and stronger promoting progress on YouTube. Alphabet additionally emphasised that it’s well-positioned for the subsequent wave of synthetic intelligence by means of its platform Gemini which is a generative AI multimodal with understanding throughout audio, video, and textual content code.

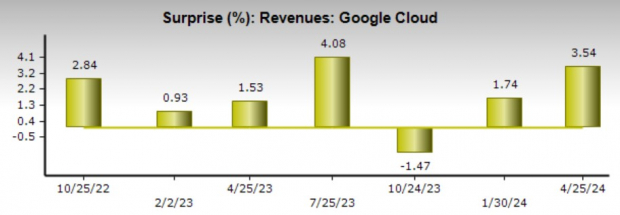

Notably, Google Cloud income beat estimates by 3% and grew 28% 12 months over 12 months to $9.57 billion with Alphabet nonetheless thought to carry the third spot within the home cloud computing market behind Amazon’s AMZN AWS and Microsoft’s MSFT Azure.

Picture Supply: Zacks Funding Analysis

Market Cap & Dividend

Alphabet’s quarterly dividend might be $0.20 per share with the primary payout set for June 17 to shareholders on report as of June 10. With the dividend and inventory buyback announcement fueling as we speak’s rally, Alphabet’s inventory briefly hit a $2 trillion market cap for the primary time since 2021 with solely Apple AAPL and Microsoft having a bigger capitalization.

Picture Supply: Zacks Funding Analysis

Backside Line

Alphabet’s Q1 report helped reconfirm expectations of double-digit high and backside line progress in fiscal 2024 and for now, GOOGL lands a Zacks Rank #3 (Maintain). Nonetheless, it wouldn’t be stunning if a purchase score is on the best way as earnings estimate revisions might pattern greater within the coming weeks.

Purchase 5 Shares BEFORE Election Day

Biden or Trump? Zacks is releasing a FREE Particular Report, Revenue from the 2024 Presidential Election (regardless of who wins).

Since 1950, presidential election years have been sturdy for the market. This report names 5 well timed shares to journey the wave of electoral pleasure.

They embody a medical producer that gained +11,000% within the final 15 years… a rental firm completely crushing its sector… an power powerhouse planning to develop its already giant dividend by 25%… an aerospace and protection standout that simply landed a probably $80 billion contract… and an enormous chipmaker constructing enormous vegetation within the U.S.

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.