With gold historically appearing as a hedge in opposition to inflation, buyers could also be eying shares that give publicity to the commodity amid latest market volatility.

Gold usually proves to be a protected haven asset throughout instances of market uncertainty as the facility of the greenback and different conventional currencies can lose worth. Notably, the Zacks Mining-Gold Business is at present within the high 19% of over 250 Zacks industries and a number of other of those shares are very enticing.

This comes as the worth of gold soared to document highs in March and remains to be over $2,300 per troy ounce. In fact, gold mining shares are sometimes searched for defensive security within the portfolio and lots of of those firms have intriguing progress prospects as nicely.

Maintaining this situation in thoughts, listed below are just a few top-rated Zacks Mining-Gold Business shares to contemplate proper now.

Picture Supply: Yahoo Finance-Gold Costs

AngloGold Ashanti PLC AU

Sporting a Zacks Rank #1 (Sturdy Purchase), AngloGold Ashanti is a gold mining firm with operations in Africa, the Americas, and Australia. AngloGold’s flagship Geita venture is a major gold mining operation positioned in northwestern Tanzania, throughout the Lake Victoria goldfields and is believed to have over 9 million ounces of gold mineral assets.

Geita is one among 5 operations owned by AngloGold in Africa and the corporate’s earnings potential could be very profitable. Fiscal 2024 earnings are anticipated to skyrocket to $2.84 per share in comparison with an adjusted lack of -$0.11 a share final 12 months. Even higher, AngloGold’s inventory trades at simply 7.3X ahead earnings and FY25 EPS is projected to develop one other 37% to $3.89 per share.

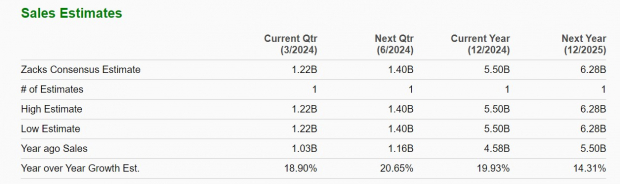

Extra reassuring is that AngloGold is forecasted to publish double-digit high line progress in FY24 and FY25 as nicely with gross sales projections nicely over $5 billion. 12 months so far, AngloGold’s inventory has soared +17% correlating with the surge in gold costs.

Picture Supply: Zacks Funding Analysis

Gold Fields Restricted GFI

Additionally boasting a Zacks Rank #1 (Sturdy Purchase) is Gold Fields Restricted, which has additionally seen its inventory pop +17% this 12 months as one the world’s largest unhedged gold producers with working mines in South Africa, Ghana, and Australia.

Regardless of its presumed market management, Gold Fields’ inventory trades at 11X ahead earnings providing a pleasant low cost to the trade common of 18.3X. Plus, annual earnings are anticipated to soar 64% this 12 months and climb one other 70% in FY25 to $2.61 per share. Whole gross sales forecasts name for 32% progress in FY24 and one other 24% leap in FY25 to $7.05 billion.

It’s additionally noteworthy that Gold Fields’ inventory nonetheless trades underneath $20 and has a 2.1% annual dividend yield that may peak revenue buyers’ consideration as nicely. To that time, Gold Fields has elevated its payout seven instances within the final 5 years and has a 52.13% annualized dividend progress charge throughout this era.

Picture Supply: Zacks Funding Analysis

Agnico Eagle Mines AEM

Rounding out the checklist is Agnico Eagle Mines which sports activities a Zacks Rank #2 (Purchase). Agnico Eagle’s inventory is up +16% 12 months so far and its regular high and backside line progress is nothing to sneeze at as a gold producer with operations in Canada, Mexico, and Finland.

Agnico Eagle additionally has exploration alternatives in america and is projected to have 13% EPS progress in FY24 with FY25 earnings anticipated to leap one other 21% to $3.05 per share. Whole gross sales are forecasted to rise 7% in FY24 and barely improve subsequent 12 months to $7.09 billion. Higher nonetheless, Agnico Eagle’s inventory affords a 2.54% annual dividend which has elevated 4 instances within the final 5 years for an annualized dividend progress charge of 26.88%.

Picture Supply: Zacks Funding Analysis

Backside Line

There are nonetheless jitters available in the market as charge cuts could also be additional away than buyers have anticipated however earnings estimate revisions for these high gold mining shares have soared during the last 60 days making now a great time to purchase.

Highest Returns for Any Asset Class

It’s not even shut. Regardless of ups and downs, Bitcoin has been extra worthwhile for buyers than another decentralized, borderless type of cash.

No ensures for the long run, however prior to now three presidential election years, Bitcoin’s returns had been as follows: 2012 +272.4%, 2016 +161.1%, and 2020 +302.8%. Zacks predicts one other vital surge in months to come back.

Hurry, Download Special Report – It’s FREE >>

AngloGold Ashanti PLC (AU) : Free Stock Analysis Report

Agnico Eagle Mines Limited (AEM) : Free Stock Analysis Report

Gold Fields Limited (GFI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.