Large-cap supplies are a staple in almost every profile. They’re reputable in nature, have much more expert protection, as well as are extremely fluid, every one of which are substantial benefits adding to their appeal amongst capitalists.

As well as, naturally, several large-caps award their investors with returns, supplying an additional helpful benefit.

For those curious about enjoying a revenue from their financial investments, 3 large-cap supplies– Power Transfer ET, Altria Team MO, as well as Prudential Financial PRU– can all be factors to consider.

Below is a graph highlighting the year-to-date efficiency of all 3 supplies, with the S&P 500 combined in as a standard.

Picture Resource: Zacks Financial Investment Study

All 3 supplies presently produce over 5% every year as well as have actually seen favorable incomes quote modifications, unquestionably a solid pairing. Allow’s take a more detailed check out every one.

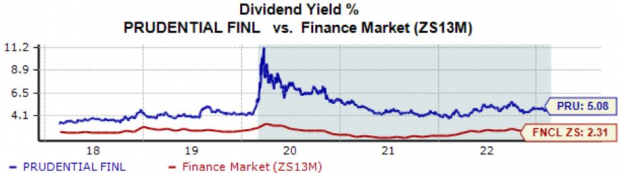

Prudential Financial

A leader in economic solutions, Prudential Financial, uses different product or services, consisting of life insurance policy, annuities, retirement-related solutions, as well as much more. Currently, PRU is a Zacks Ranking # 2 (Buy).

Picture Resource: Zacks Financial Investment Study

PRU’s yearly returns return presently rests at 5.1%, greater than increase its Zacks Financing market standard. Additionally, the firm’s 51% payment proportion lives on the lasting side.

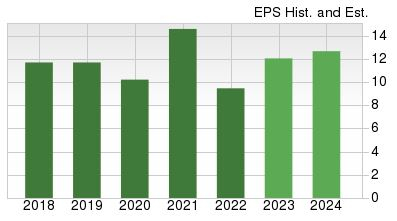

Picture Resource: Zacks Financial Investment Study

The firm’s profits aims to increase perfectly, with price quotes for its existing suggesting a 28% enter incomes. As well as in FY24, approximates mention an additional 5% of development.

Picture Resource: Zacks Financial Investment Study

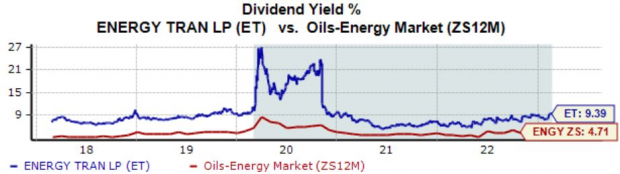

Power Transfer

Power Transfer possesses as well as runs varied profiles of power possessions mostly in the USA. Presently, ET sporting activities a Zacks Ranking # 2 (Buy).

Picture Resource: Zacks Financial Investment Study

It’s almost difficult to disregard Power Transfer’s returns metrics; the firm’s yearly returns presently stands high at 9.4%, no place near the Zacks Oils as well as Power market standard.

While the return is unquestionably remarkable, it is necessary to bear in mind that it’s prone to a modification in company problems.

Picture Resource: Zacks Financial Investment Study

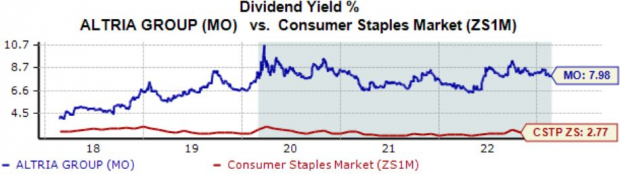

Altria Team

Altria Team is a world-leading manufacturer as well as marketing professional of cigarettes, cigarette, as well as comparable items. Like the supplies over, MO sporting activities a Zacks Ranking # 2 (Buy), seeing its incomes expectation drift greater throughout all durations.

Picture Resource: Zacks Financial Investment Study

Altria compensates its investors handsomely; its yearly returns presently generates 8%, well over the Zacks Customer Staples market standard.

Remarkably, the firm has actually expanded its payment by greater than 5% over the last 5 years.

Picture Resource: Zacks Financial Investment Study

Additionally, MO’s appraisal multiples do not show up pricey, with its 9.3 X ahead incomes several resting listed below its 10.5 X five-year average as well as Zacks market standard.

Picture Resource: Zacks Financial Investment Study

Profits

Capitalists ought to know that high returns can be unsustainable from a long-lasting viewpoint as well as generally obtain reduced when company isn’t as productive, possibly guiding away revenue capitalists that like dependability.

When seeking returns dependability, Returns Aristocrats are an excellent alternative. A couple of Returns Aristocrats that sporting activity a positive Zacks Ranking consist of Archer Daniels Midland ADM as well as Coca-Cola KO.

Still, all 3 supplies above– Power Transfer ET, Altria Team MO, as well as Prudential Financial PRU– presently lug yearly returns returns above 5%, making them legitimate factors to consider for capitalists aiming to pile money promptly.

Is THIS the Ultimate New Clean Power Resource? (4 Ways to Earnings)

The globe is significantly concentrated on getting rid of nonrenewable fuel sources as well as increase use eco-friendly, tidy power resources. Hydrogen gas cells, powered by the most plentiful compound in deep space, can supply a limitless quantity of ultra-clean power for several sectors.

Our immediate unique record exposes 4 hydrogen supplies keyed for large gains – plus our various other leading tidy power supplies.

CocaCola Company (The) (KO) : Free Stock Analysis Report

Altria Group, Inc. (MO) : Free Stock Analysis Report

Prudential Financial, Inc. (PRU) : Free Stock Analysis Report

Archer Daniels Midland Company (ADM) : Free Stock Analysis Report

Energy Transfer LP (ET) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as point of views shared here are the sights as well as point of views of the writer as well as do not always mirror those of Nasdaq, Inc.