It is not a surprise that the consolidated weight of raised rising cost of living, climbing rate of interest as well as unpredictability concerning the economic climate have actually compelled customers to transform their costs habits.

The concern has actually unquestionably gone to have fun with lower-income homes for time currently. However we can without effort value that it will certainly not remain limited to this customer sector alone as well as will certainly probably go up the earnings chain in the days in advance.

We saw several of that in the Walmart ( WMT) record that revealed the store taking advantage of higher-income customers ‘trading down’ to its shops in feedback to the abovementioned headwinds. On the other hand, a large factor to Walmart’s weak advice for this year shows a regulating customer costs background that some in the marketplace view as extremely conventional.

The retail company is a challenging as well as affordable area also in ‘regular’ times as well as these are anything yet regular times.

They require simply the correct amount of supply, or else they will certainly either shed sales if they do not have adequate product as held true previously in the pandemic or they will certainly require to use steeper price cuts as well as injure margins if they have excessive of it, as we saw with Walmart as well as Target ( TGT) in 2014.

Stores likewise require to ensure that they have the appropriate sort of product, as we saw with Target as well as Walmart having excessive of the patio area furnishings that customers weren’t thinking about purchasing. Maintaining shops totally staffed in a limited labor market as well as making sure ideal quantity of rate discount rates are several of the various other difficulties that big-box drivers like Walmart, Target as well as others encounter daily.

Walmart’s solid efficiency on the supply front over the last 2 quarters is a large reason the supply has actually done so better about Target whose outcomes are appearing prior to the marketplace’s open on Tuesday, February 28 th

Target shares are among those supplies that actually go on quarterly launches. The supply was down adhering to each of the last 3 launches, with the Might 18 th 2022 record was one for the document publications when the supply shed greater than a quarter of its worth as the business’s supply as well as retailing issues took spotlight. This places a costs on Target’s launch Tuesday early morning offered the supply’s excellent run this year.

Everything boils down to implementation as well as administration performance.

In a background of regulating as well as moving customer costs habits, some sellers have actually been extra effective than others. Walmart has actually been much better, Target much less so, though Target shares have actually been outstanding entertainers in current weeks. Macy’s ( M), which likewise reports today, has actually been among the laggards.

You can see several of this in 1 year efficiency of Walmart (orange line, up +3.3%), Target (blue line, down -17.6%), Macy’s (eco-friendly line, down -22.5%) shares about the S&P 500 index (red line, down -10.1%).

Picture Resource: Zacks Financial Investment Study

Because the beginning of 2023, nevertheless, Target shares are up +10.1% vs. +4.5% for the S&P 500 index, while Walmart as well as Macy’s shares are down -0.6% as well as -1%, specifically.

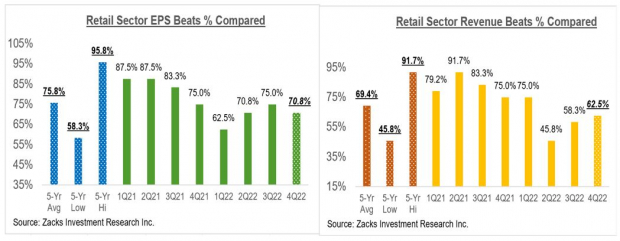

Relative to the Retail industry’s 2022 Q4 incomes period scorecard, we currently have arise from 24 of the 33 sellers in the S&P 500 index. Overall Q4 incomes for these sellers are down -33% from the very same duration in 2014 on +6.5% greater earnings, with 70.8% whipping EPS quotes as well as 62.5% whipping earnings quotes.

The contrast graphes listed below placed the Q4 defeats portions for these sellers in a historic context.

Picture Resource: Zacks Financial Investment Study

As you can see above, sellers have actually been battling to find out with favorable shocks so far, with the variation about the historic arrays specifically remarkable on the EPS side.

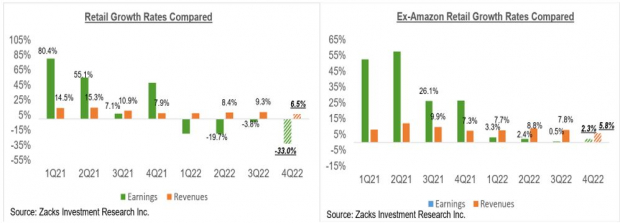

Relative to the incomes as well as earnings development prices, Amazon.com’s -85.4% incomes decrease plays a considerable function in the team’s weak year-over-year development price for the industry (Amazon.com becomes part of the Zacks Retail industry, as well as not the Zacks Innovation industry). A lot of the Retail industry incomes records that have actually appeared currently remain in the electronic component of the area, with the extra conventional sellers began the coverage cycle with recently’s Walmart launch as well as a host of others on deck today.

As most of us understand, the electronic as well as brick-and-mortar drivers have actually been merging for time currently, with Amazon.com currently a respectable sized brick-and-mortar driver after Whole Foods as well as Walmart an expanding online supplier. This long-lasting pattern obtained a big increase from the Covid lockdowns.

Both contrast graphes listed below reveal the Q4 incomes as well as earnings development about various other current durations, both with Amazon.com’s outcomes (left side graph) as well as without Amazon.com’s numbers (appropriate side graph).

Picture Resource: Zacks Financial Investment Study

Today’s Coverage Docket

We have greater than 550 firms on deck to report outcomes today, consisting of 30 S&P 500 participants. Remarkable firms reporting today, in addition to the abovementioned sellers consist of Berkshire Hathaway, Broadcom, Salesforce.com, as well as others.

2022 Q4 Revenues Period Scorecard

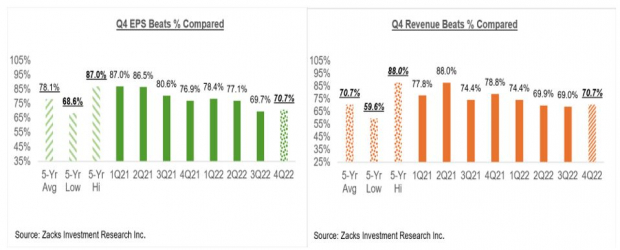

Since Friday, February 24th, we currently have Q4 arise from 468 S&P 500 participants or 93.6% of the index’s overall subscription. Overall incomes for these firms are down -5.7% from the very same duration in 2014 on +6% greater earnings, with 70.7% whipping EPS quotes as well as an equivalent percentage whipping earnings quotes.

The contrast graphes listed below placed the EPS as well as earnings beats portions in Q4 in a historic context.

Picture Resource: Zacks Financial Investment Study

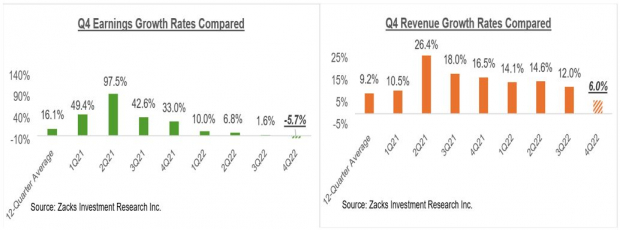

The contrast graphes listed below placed the incomes as well as earnings development prices in Q4 in a historic context.

Picture Resource: Zacks Financial Investment Study

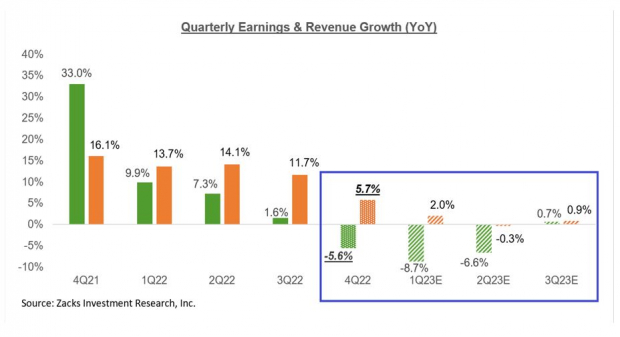

As you can see, there is a remarkable slowdown in the development trajectory, both for incomes in addition to earnings. Please keep in mind that this decreasing development pattern does not transform in any kind of purposeful method whether we check out it on an ex-Finance or ex-Tech bases.

The Revenues Broad View

We have actually the whole time been describing the total image that arised from the 2022 Q4 reporting cycle as sufficient; not excellent, yet okay either.

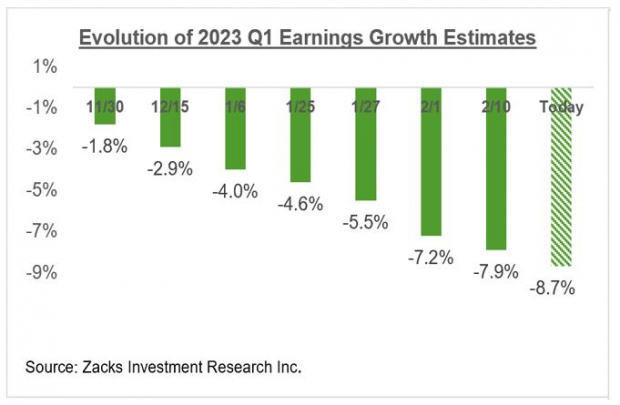

The modifications pattern remains to be adverse, with the expectation for a variety of markets on the weak side. However it follows the developing macroeconomic image as well as much from the alarming situation that lots of in the marketplace been afraid. You can see this in the graph listed below that demonstrates how quotes for the present duration (2023 Q1) have actually progressed in current weeks.

Picture Resource: Zacks Financial Investment Study

Please keep in mind that while Q1 quotes are boiling down, the speed as well as size of cuts is significantly listed below what we had actually seen in advance of the beginning of the last number of incomes periods.

The graph listed below programs the accumulated incomes overall for the index considering that the beginning of in 2014.

Picture Resource: Zacks Financial Investment Study

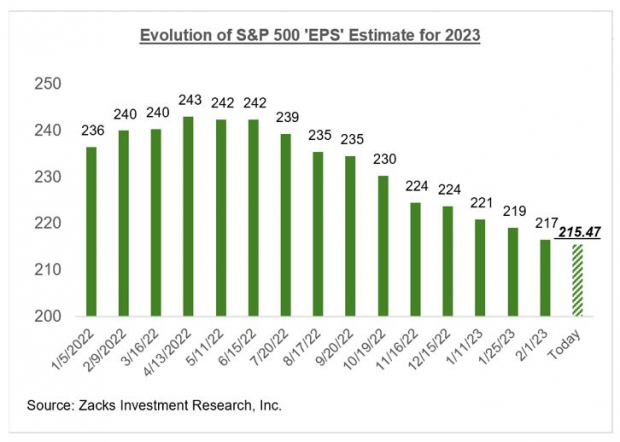

Please keep in mind that the $1.911 trillion in anticipated accumulated incomes for the index in 2023 approximate to an index ‘EPS’ of $215.47, below $215.89 recently as well as the $215.90 tally we get on track to have actually seen in 2022.

The graph listed below programs this 2023 index ‘EPS’ price quote has actually progressed considering that the beginning of 2022.

Picture Resource: Zacks Financial Investment Study

With the mass of the 2022 Q4 reporting cycle currently behind us, modifications have actually primarily downplayed for the following couple of weeks though the Retail industry outcomes will certainly have a bearing on exactly how assumptions for that area advance.

We remain to think that a conclusive keep reading the modifications front will just arise when we have actually seen an end to the Fed’s tightening up cycle as well as the influence of the advancing tightening up on financial development.

That claimed, about pre-season doom-and-gloom fears, this is rather comforting end result.

The graph listed below programs the anticipated 2022 Q4 incomes as well as earnings development assumption in the context of where development has actually remained in current quarters as well as what is anticipated in the following couple of quarters.

Picture Resource: Zacks Financial Investment Study

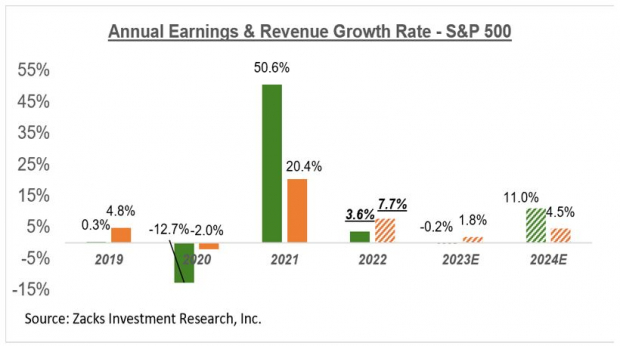

The graph listed below programs the total incomes image on a yearly basis.

Picture Resource: Zacks Financial Investment Study

As you can see below, quotes for 2023 are currently a hair listed below the 2022 degree. For even more information concerning the developing incomes image, please have a look at our regular Revenues Fads report below >>>>> > > > Exploring the Retail Sector and Looking Ahead to 2023 Earnings

7 Ideal Supplies for the Following 1 month

Simply launched: Specialists boil down 7 elite supplies from the present checklist of 220 Zacks Ranking # 1 Solid Buys. They consider these tickers “Probably for Very Early Rate Pops.”

Because 1988, the complete checklist has actually defeated the marketplace greater than 2X over with a typical gain of +24.8% annually. So make sure to provide these carefully picked 7 your prompt interest.

Macy’s, Inc. (M) : Free Stock Analysis Report

Target Corporation (TGT) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as point of views revealed here are the sights as well as point of views of the writer as well as do not always mirror those of Nasdaq, Inc.