Ciena Firm CIEN is arranged to report second-quarter financial 2023 outcomes on Jun 6.

In April, Ciena reaffirmed support for both second-quarter and also full-year financial 2023 that it offered with its last revenues launch. For second-quarter financial 2023, the business remains to anticipate incomes in the variety of $1,035-$ 1,115 million. Changed gross margin is approximated to be reduced 40%. Changed operating budget are predicted to be $335 million.

The Zacks Agreement Price quote for revenues is fixed at 60 cents per share, recommending a 20% rise from the year-ago quarter’s degrees. The agreement price quote for incomes is fixed at $1.09 billion, suggesting a gain of 14.4% from the year-ago quarter’s degrees.

Ciena Firm Rate and also EPS Shock

Ciena Corporation price-eps-surprise|Ciena Firm Quote

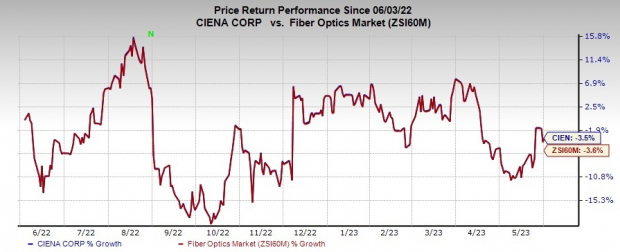

CIEN has a routing four-quarter revenues shock of 182%, typically. Shares of Ciena have actually shed 3.5% in the previous year compared to the sub-industry’s decrease of 3.6%.

Picture Resource: Zacks Financial Investment Study

Elements to Keep In Mind

CIEN is among the leading carriers of optical networking tools, software program and also solutions. The business’s efficiency is most likely to have actually been driven by boosted network web traffic, need for transmission capacity and also the fostering of cloud designs.

Along with enhancing need for its remedies in the 5G, cloud, AI and also automation area, CIEN is spending thoroughly to get chances in quick expanding markets in the next-gen city and also side remedies.

CIEN’s transmitting and also changing remedies are most likely to have actually seen solid uptake. Payment from the Vyatta system, which Ciena obtained from AT&T, is most likely to have actually preferred the sector.

Ciena is seeing solid energy for its WaveLogic 5 Extreme remedy. In the last documented quarter, the business included 13 brand-new consumers for its WaveLogic 5 Extreme remedy.

Step-by-step gains from healthy and balanced efficiency of its software program automation service, specifically Blue Earth Software application, are most likely to have actually assisted the leading line.

Nonetheless, worldwide supply-chain characteristics, lengthened preparations, element scarcities and also relevant greater logistics expenses stay issues. Rising cost of living and also greater expenditures on item advancement in the middle of rigid competitors in the networking area may even more have actually restricted margin development in the to-be-reported quarter.

What Our Design Claims

Our tested design does not effectively anticipate a making beat for Ciena this moment around. The mix of a favorable Earnings ESP and also a Zacks Ranking # 1 (Solid Buy), 2 (Buy) or 3 (Hold) raises the chances of an incomes beat. Yet that’s not the instance below.

Ciena has a Profits ESP of 0.00% and also a Zacks Ranking # 2. You can discover the most effective supplies to get or market prior to they’re reported with our Earnings ESP Filter.

Supplies to Think About

Below are some supplies that you might take into consideration as our design reveals that these have the best mix of components to defeat on revenues this period.

Trip.com Team Limited TCOM has a Profits ESP of +9.43% and also shows off a Zacks Ranking # 1, currently. TCOM is slated to launch quarterly numbers on Jun 7. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Agreement Price quote for revenues is fixed at 27 cents per share. The agreement price quote for incomes is fixed at $1.18 billion. The supply has actually gotten 48.3% in the previous year.

Ferguson FERG has a Profits ESP of +7.64% and also currently brings a Zacks Ranking # 2. FERG is arranged to launch quarterly numbers on Jun 6.

The Zacks Agreement Price quote for FERG’s to-be-reported quarter’s revenues is fixed at $2.18 per share. The agreement price quote for incomes is fixed at $7.05 billion. The supply has actually gotten 22% in the previous year.

Academy Sports and also Outdoors ASO has a Profits ESP of +1.76% and also presently brings a Zacks Ranking # 3. ASO will certainly launch quarterly numbers on Jun 6.

The Zacks Agreement Price quote for ASO’s to-be-reported quarter’s revenues is fixed at $1.61 per share. For incomes, the agreement price quote is fixed at $1.45 billion. The supply has actually gotten 40% in the previous year.

Remain on top of upcoming revenues statements with the Zacks Earnings Calendar.

Zacks Discloses ChatGPT “Sleeper” Supply

One obscure business goes to the heart of a particularly dazzling Expert system industry. By 2030, the AI market is anticipated to have a web and also iPhone-scale financial effect of $15.7 Trillion.

As a solution to visitors, Zacks is supplying a bonus offer record that names and also describes this eruptive development supply and also 4 various other “need to purchases.” Plus extra.

Download Free ChatGPT Stock Report Right Now >>

Ciena Corporation (CIEN) : Free Stock Analysis Report

Trip.com Group Limited Sponsored ADR (TCOM) : Free Stock Analysis Report

Academy Sports and Outdoors, Inc. (ASO) : Free Stock Analysis Report

Ferguson plc (FERG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also viewpoints revealed here are the sights and also viewpoints of the writer and also do not always show those of Nasdaq, Inc.