The more comprehensive Zacks Building market is really eye-catching currently flaunting 20 supplies that presently sporting activity a Zacks Ranking # 1 (Solid Buy).

Among the standout sectors in the area is the Structure Products-Home Builders Market which is presently in Zacks leading 2%. The cumulative complete return (consisting of returns) of the market is +35% year to day to conveniently cover the S&P 500’s +14% as well as also the Nasdaq’s +27%.

Below is a check out several of the highly-ranked supplies in the market that financiers might intend to think about now.

Photo Resource: Zacks Financial Investment Study

Meritage Residences ( MTH): As one of the leading developers as well as building contractors of single-family residences, Meritage Residences supply is protruding with incomes price quotes rising throughout the quarter.

Financial 2023 EPS price quotes have actually climbed up 21% in the last 2 months to $15.57 per share contrasted to price quotes of $12.84 a share 60 days earlier. Much more appealing, FY24 incomes price quotes have actually increased 18% acting as an additional stimulant for even more advantage in Meritage supply which presently trades at $129 a share.

Photo Resource: Zacks Financial Investment Study

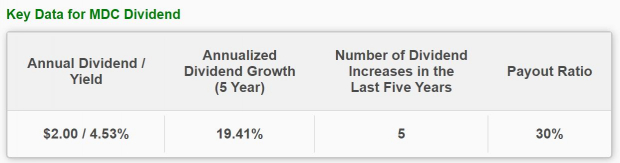

MDC Holdings ( MDC): Financiers looking for development as well as worth might have a strong alternative with MDC Holdings’ supply. Relieving rising cost of living is enhancing business setting for MDC which is taken part in homebuilding as well as economic solutions consisting of home loan procedures. Particularly, MDC gets, creates, constructs, as well as markets single-family removed residences to novice as well as move-up purchasers.

Supporting rate of interest ought to vibrant well for MDC complying with among its extra lucrative years with take-home pay at $562 million in 2022 or $7.67 per share. Trading under $50 a share, MDC supply resembles an eye-catching alternative to profit from enhancing own a home amongst Generation Z as well as more youthful Millennials.

MDC’s 4.53% returns return is really eye-catching for revenue hunters as it is well over the market standard of 0.44% as well as the S&P 500’s 1.48% standard.

Photo Resource: Zacks Financial Investment Study

Toll Sibling ( TOL): From an assessment point ofview, Toll Sibling is just one of the extra eye-catching firms in the prospering Structure Products-Home Builders Market.

Toll Sibling has a particular niche in the market as a building contractor of single-family removed as well as connected residence areas, master-planned high-end property resort-style golf areas, as well as city real estate areas.

With incomes price quotes significantly greater for FY23 as well as FY24, Toll Sibling supply still trades at 7.1 X ahead incomes. At $74 a share, Toll Sibling supply is trading 83% listed below its years high of 43.1 X incomes as well as at a 31% discount rate to the average of 10.7 X. Furthermore, Toll Sibling supply supplies a good discount rate to the market standard of 9.1 X as well as is well under the S&P 500’s 19.9 X.

Photo Resource: Zacks Financial Investment Study

Profits

Relieving rising cost of living as well as maintaining rate of interest are beginning to enhance the building market with lots of homebuilders positioned to profit. Along with their Zacks Ranking # 1 (Solid Buy), these supplies additionally have a general “A” VGM Design Ratings quality for the mix of Worth, Development, as well as Energy.

Various other alternatives to think about amongst the premier Structure Products-Home Builders Market are D.R. Horton ( DHI) as well as PulteGroup ( PHM).

4 Oil Supplies with Substantial Benefits

International need for oil is via the roofing … as well as oil manufacturers are battling to maintain. So despite the fact that oil rates are well off their current highs, you can anticipate large make money from the firms that provide the globe with “black gold.”

Zacks Financial investment Study has actually simply launched an immediate unique record to assist you count on this pattern.

In Oil Market ablaze, you’ll uncover 4 unforeseen oil as well as gas supplies placed for large gains in the coming weeks as well as months. You do not intend to miss out on these suggestions.

Download your free report now to see them.

Toll Brothers Inc. (TOL) : Free Stock Analysis Report

Meritage Homes Corporation (MTH) : Free Stock Analysis Report

M.D.C. Holdings, Inc. (MDC) : Free Stock Analysis Report

PulteGroup, Inc. (PHM) : Free Stock Analysis Report

D.R. Horton, Inc. (DHI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as viewpoints shared here are the sights as well as viewpoints of the writer as well as do not always mirror those of Nasdaq, Inc.